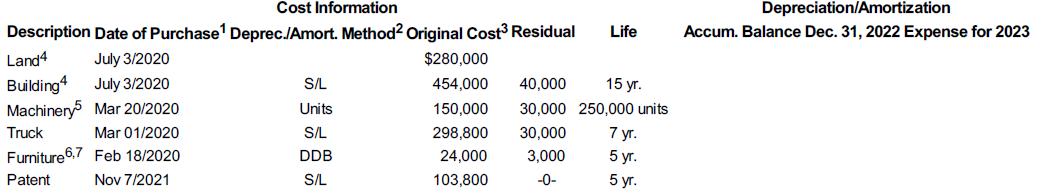

Times TeleComs PPE subledger at January 1, 2023, appeared as follows: Additional information: 1 The company calculates

Question:

Times TeleCom’s PPE subledger at January 1, 2023, appeared as follows:

Additional information:

1 The company calculates depreciation and amortization to the nearest whole month.

2 S/L = Straight-line; DDB = Double-declining-balance; Units = Units-of-production

3 There were no disposals, revisions, or impairments prior to January 1, 2023.

4 At the beginning of 2023, it was determined that the land and building would be used for five years less than originally estimated due to the need to expand.

5 Actual units produced: 2020, 45,000; 2021, 55,000; 2022, 52,000; 2023, 65,000.

6 Used office equipment and furniture were purchased on April 10, 2023, for a total of $114,000 at a bankruptcy sale. The appraised value of the office equipment was $96,000 and of the furniture $72,000. The old furniture was given to a charitable organization on April 12, 2023.

7 The estimated useful lives and residual values of the April 10 purchases were four years and $10,000 for the office equipment, and five years and $4,000 for the furniture. These assets will be depreciated using the DDB method.

Required

1. Complete the PPE subledger; round calculations to the nearest dollar.

2. Using the information from the PPE subledger completed in part (a) and the following December 31, 2023, adjusted account balances, prepare a single-step income statement and statement of changes in equity for the year ended December 31, 2023, along with the December 31, 2023, classified balance sheet: Cash, $30,000; Accounts Receivable, $72,000; Prepaid Insurance, $15,600; Accounts Payable, $68,000; Unearned Revenue, $53,800; Notes Payable due in 2026, $284,000; Susan Times, Capital, $421,180; Susan Times, Withdrawals, $204,000; Revenue Earned, $950,000; Salaries Expense, $294,000; Insurance Expense, $30,000; Loss on disposal of furniture, $5,184. Susan Times, the owner, made no investments during 2023.

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9781260881332

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris