Velor Ltd., a patio gas heater company, showed the following adjusted information on August 31, 2017, its

Question:

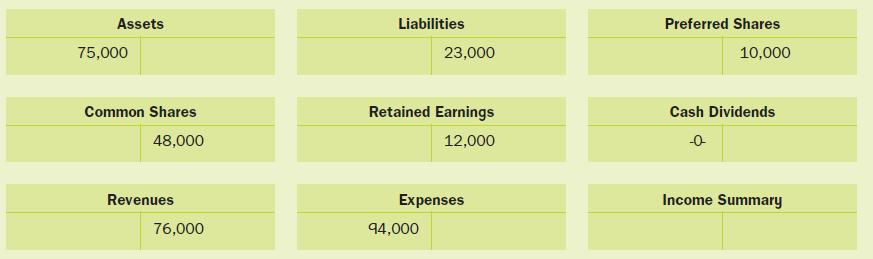

Velor Ltd., a patio gas heater company, showed the following adjusted information on August 31, 2017, its second year-end:

a. Prepare the appropriate closing entries.b. Prepare a statement of changes in equity for the year ended August 31, 2017. No shares were issued during the second year.

Transcribed Image Text:

Assets 75,000 Common Shares 48,000 Revenues 76,000 Liabilities 23,000 Retained Earnings 12,000 Expenses 94,000 Preferred Shares 10,000 Cash Dividends -0- Income Summary

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 77% (9 reviews)

a b 2017 Aug 31 Revenues Income Summary To close revenues ...View the full answer

Answered By

Mishark muli

Having any assignments and any other research related work? worry less for I am ready to help you with any task. I am quality oriented and dedicated always to produce good and presentable work for the client once he/she entrusts me with their work. i guarantee also non plagiarized work and well researched work to give you straight As in all your units.Feel free to consult me for any help and you will never regret

4.70+

11+ Reviews

37+ Question Solved

Related Book For

Fundamental Accounting Principles Volume 2

ISBN: 9781259087363

15th Canadian Edition

Authors: Kermit Larson, Heidi Dieckmann

Question Posted:

Students also viewed these Business questions

-

Velor Ltd. showed the following adjusted information on August 31, 2014, its second year-end: a. Prepare the appropriate closing entries. b. Prepare a statement of changes in equity for the year...

-

Velor Ltd., a patio gas heater company, showed the following adjusted information on August 31, 2020, its second year-end: a. Prepare the appropriate closing entries. b. Prepare a statement of...

-

The financial statements of JJ Ltd and KK Ltd for the year to 30 June 2018 are shown below: Statements of comprehensive income for the year to 30 June 2018. Statements of financial position as at 30...

-

Measuring the height of a California redwood tree is very difficult because these trees grow to heights over 300 feet. People familiar with these trees understand that the height of a California...

-

Identify the three types of audits that a governmental organization might obtain.

-

For years, Ferrari has been known as the manufacturer of expensive luxury automobiles. The company plans to attract the major segment of the car-buying market that purchases medium-priced...

-

a. Calculate the standard error of the sampling distribution for Sample 1. b. Calculate the standard error of the sampling distribution for Sample 2. c. Suppose you were to calculate the difference...

-

A call option is the right to buy stock at $50 a share. Currently the option has six months to expiration, the volatility of the stock (standard deviation) is 0.30, and the rate of interest is 10...

-

just the first question Management of Mittel Rhein AG of Kln, Germany, would like to reduce the amount of time between when a customer places an order and when the order is shipped. For the first...

-

Fierra Sceptre Inc. was authorized to issue 50,000 $1.50 preferred shares and 300,000 common shares. During 2017, its first year of operations, the following selected transactions occurred: Required...

-

Bellevue Ltd. reported profit of $860,000 for its year ended December 31, 2017. Calculate earnings per share given the following additional information at December 31, 2017: Preferred shares, $2...

-

Which month of the year, on average, has had the highest stock market returns as measured by a small-stock portfolio? a. January b. March c. June d. December.

-

Assume a Poisson distribution with =5.6. Find the following probabilities. a. X=1 b. X <1 c. X>1 d. X1 a. P(X=1)= (Round to four decimal places asneeded.) b. P(X <1)= (Round to four decimal places...

-

345879 The any reported the following January purchases and sales data for its only prauct. The company uses a perpetual inventory system. REQUIRED: Determine the cost assigned to ending inventory...

-

How do changing geopolitical landscapes, such as shifting alliances and emerging power centers, influence conflict resolution strategies, and what adjustments are necessary to address new global...

-

50 21 2. Determine the inclination and period of the satellite which produced the ground trace below. Show all calculations. Suteite 17 11-140-130-120-110 tonn an 20 6058 am 50 210 0 10 20 30 50 60...

-

This activity aims to provide practical experience in preparing tax forms related to business income and depreciation. It emphasizes the importance of accurate reporting and adherence to tax...

-

1. The figure shows a graph that compares the present values of two ordinary annuities of $800 quarterly, one at 6% compounded quarterly and one at 9% compounded quarterly. (a) Determine which graph...

-

A parking lot charges $3 for the first hour (or part of an hour) and $2 for each succeeding hour (or part), up to a daily maximum of $10. (a) Sketch a graph of the cost of parking at this lot as a...

-

On October 6, 2023, Norwood Co., an office equipment supplier, sold a copier for cash of $21,000 (cost $13,900) with a two-year parts and labour warranty. Based on prior experience, Norwood expects...

-

Music Media Ltd. prepares statements quarterly. Part A: Required 1. Based on 2022 results, Musics estimated tax liability for 2023 is $285,960. Music will accrue 1/12 of this amount at the end of...

-

Superior Skateboard Company, located in Ontario, is preparing adjusting entries at December 31, 2023. An analysis reveals the following: a. During December, Superior sold 6,500 skateboards that carry...

-

Required information Skip to question [ The following information applies to the questions displayed below. ] Golden Corporation's current year income statement, comparative balance sheets, and...

-

Glencove Company makes one model of radar gun used by law enforcement officers. All direct materials are added at the beginning of the manufacturing process. Information for the month of September...

-

Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is...

Study smarter with the SolutionInn App