Suppose the income statement for Goggle Company reports $95 of net income, after deducting depreciation of $35.

Question:

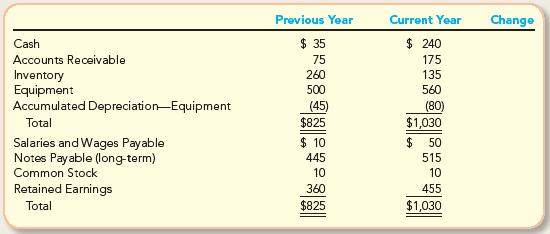

Suppose the income statement for Goggle Company reports $95 of net income, after deducting depreciation of $35. The company bought equipment costing $60 and obtained a long-term bank loan for $70. The company’s comparative balance sheet, at December 31.

Required:

1. Calculate the change in each balance sheet account and indicate whether each account relates to operating, investing, and/or financing activities.

2. Prepare a statement of cash flows using the indirect method.

3. In one sentence, explain why an increase in accounts receivable is subtracted.

4. In one sentence, explain why a decrease in inventory is added.

5. In one sentence, explain why an increase in salaries and wages payable is added.

6. Are the cash flows typical of a start-up, healthy, or troubled company? Explain.

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-0078025914

5th edition

Authors: Fred Phillips, Robert Libby, Patricia Libby