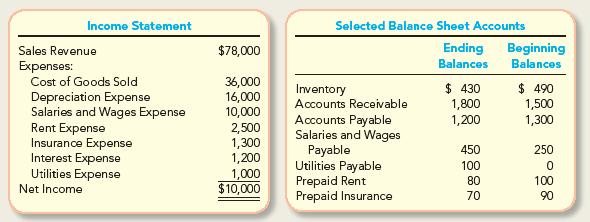

The income statement and selected balance sheet information for Calendars Incorporated for the year ended December 31

Question:

The income statement and selected balance sheet information for Calendars Incorporated for the year ended December 31 is presented below.

Required:

Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

To prepare the cash flows from operating activities section of the statement of cash flows using the ...View the full answer

Answered By

Amar Kumar Behera

I am an expert in science and technology. I provide dedicated guidance and help in understanding key concepts in various fields such as mechanical engineering, industrial engineering, electronics, computer science, physics and maths. I will help you clarify your doubts and explain ideas and concepts that are otherwise difficult to follow. I also provide proof reading services. I hold a number of degrees in engineering from top 10 universities of the US and Europe.

My experience spans 20 years in academia and industry. I have worked for top blue chip companies.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Financial Accounting

ISBN: 978-0078025914

5th edition

Authors: Fred Phillips, Robert Libby, Patricia Libby

Question Posted:

Students also viewed these Business questions

-

The income statement and selected balance sheet information for Calendars Incorporated for the year ended December 31, 2013, is presented below. Refer to the information in PB12-2. Required: Prepare...

-

The income statement and selected balance sheet information for Calendars Incorporated for the year ended December 31, 2013, is presented below. Income Statement Sales Revenue ........ $78,000...

-

The income statement and selected balance sheet information for Calendars Incorporated for the year ended December 31, 2017, is presented below. Required: Prepare the cash flows from operating...

-

Neer Department Store uses the retail inventory method to estimate its monthly ending inventories. The following information is available for two of its departments at August 31, 2011. Sporting Goods...

-

During the month, Lathers Co. received $400,000 in cash and paid out $290,000 in cash. (a) Do the data indicate that Lathers Co. had net income of $110,000 during the month? Explain. (b) If the...

-

The mother of a rape victim, with whom you have been working, calls and says that ever since the rape, her daughter has been crying and unable to eat or sleep. She tells you it is urgent that she...

-

Describe how learning cycles can be used to identify project risks. AppendixLO1

-

Based on the information below, record the adjusting journal entries that must be made for June Kang Consulting Services on December 31, 2016. The company has a December 31 fiscal year-end. Use 18 as...

-

Question 3 [36] Baker Boss, a registered VAT vendor, is buying and selling baking-related items to big retail outlets across the country. All retailers that the business trades with are also...

-

In defining an asset class, why is the correlation between the returns of asset classes important?

-

Suppose the local movie theater is offering four different movies on the next four Saturdays. And according to your taste in movies, each Saturdays movie will be better than the previous weeks movie....

-

Use the situational perspective on organizational behaviour to describe the growth strategies developed by Netflix and the competitive strategies adopted by both Netflix and Blockbuster. Explain how...

-

Activity 1.4: When Less Becomes More For this activity, refer to the images shown. This is an activity which was performed for you if you do not have available two identical mirrors at home. But if...

-

! Required information [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced...

-

During the early part of winter, one morning, two hunters decided to go quail hunting on a property where the owner had given them permission to hunt. A nearby forest ranger saw the hunters and...

-

Required information [The following information applies to the questions displayed below.] Trini Company set the following standard costs per unit for its single product. Direct materials (30 pounds...

-

A horticulturist knows that the weights of honeybees that have previously visited her orchard are normally distributed with a mean of 0.87 grams, and a population standard deviation of 0.15 grams....

-

Using the loan and payment plan developed in Problem 4-40, determine the month that the final payment is due, and the amount of the final payment, if $500 is paid for payment 8 and $280 is paid for...

-

Smthe Co. makes furniture. The following data are taken from its production plans for the year. Required: 1. Determine the hazardous waste disposal cost per unit for chairs and for tables if costs...

-

Kreiser Company had three intangible assets at the end of 2017 (end of the accounting year): a. A patent was purchased from J. Miller on January 1, 2017, for a cash cost of $5,640. When purchased,...

-

Conrad Inc. purchased a patent for $1,000,000 for a specialty line of patented switch plate covers and outlet plate covers specifically designed to light up automatically when the power fails. Assume...

-

The following information was reported by Amuse Yourself Parks (AYP) for 2012: Net fixed assets (beginning of year).......... $8,450,000 Net fixed assets (end of year)...................... 8,250,000...

-

An underlying asset price is at 100, its annual volatility is 25% and the risk free interest rate is 5%. A European call option has a strike of 85 and a maturity of 40 days. Its BlackScholes price is...

-

Prescott Football Manufacturing had the following operating results for 2 0 1 9 : sales = $ 3 0 , 8 2 4 ; cost of goods sold = $ 2 1 , 9 7 4 ; depreciation expense = $ 3 , 6 0 3 ; interest expense =...

-

On January 1, 2018, Brooks Corporation exchanged $1,259,000 fair-value consideration for all of the outstanding voting stock of Chandler, Inc. At the acquisition date, Chandler had a book value equal...

Study smarter with the SolutionInn App