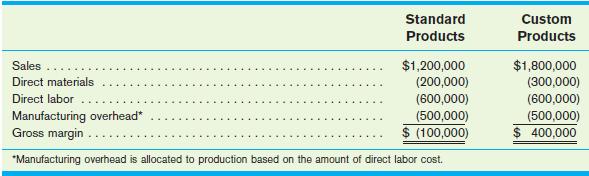

Allocating Batch-Level and Product Line Manufacturing Overhead Costs Giles Company has two divisions. Gross margin computations for

Question:

Allocating Batch-Level and Product Line Manufacturing Overhead Costs Giles Company has two divisions. Gross margin computations for these two divisions for 2009 are as follows:

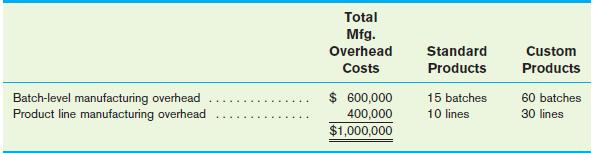

Giles has determined that its total manufacturing overhead cost of $1,000,000 is a mixture of batch-level costs and product line costs. Giles has assembled the following information concerning the manufacturing overhead costs, the annual number of production batches in each division, and the number of product lines in each division:

1. Prepare gross margin calculations for Giles’ two divisions assuming that manufacturing overhead is allocated based on the number of batches and number of product lines.

1. Prepare gross margin calculations for Giles’ two divisions assuming that manufacturing overhead is allocated based on the number of batches and number of product lines.

2. By how much do the profits of the two divisions differ between the direct labor cost allocation method and ABC allocation? Assuming that allocating manufacturing overhead using the ABC method is more correct, what can you conclude from this difference?

Step by Step Answer:

Accounting Concepts And Applications

ISBN: 9780324376159

10th Edition

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice, Monte R. Swain