Calculate the BlackScholes option price in each of the cases that follow. The risk-free rate and standard

Question:

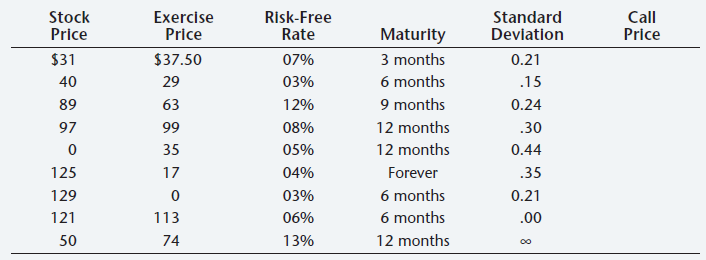

Calculate the Black–Scholes option price in each of the cases that follow. The risk-free rate and standard deviation are quoted in annual terms. The last three cases may require some thought.

Round computed values for d1 and d2 to the nearest values in Table 25A.1 for determining N(d1) and N(d2), respectively.

Transcribed Image Text:

Exercise Standard Call Stock Risk-Free Rate Price Price Maturity 3 months 6 months 9 months 12 months 12 months Forever 6 months 6 months 12 months Deviation 0.21 .15 0.24 .30 Price $31 40 89 97 $37.50 29 63 07% 03% 12% 99 08% 35 05% 0.44 125 129 121 50 .35 17 04% 0.21 03% 113 06% .00 74 13% 00

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

Accurate values for the standard normal distribution are used here based on Excels NO...View the full answer

Answered By

Collins Omondi

I have been an academic and content writer for at least 6 years, working on different academic fields including accounting, political science, technology, law, and nursing in addition to those earlier listed under my education background.

I have a Bachelor’s degree in Commerce (Accounting option), and vast knowledge in various academic fields Finance, Economics, Marketing, Management, Social Science, Women and Gender, Business law, and Statistics among others.

4.80+

4+ Reviews

16+ Question Solved

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-0071051606

8th Canadian Edition

Authors: Stephen A. Ross, Randolph W. Westerfield

Question Posted:

Students also viewed these Business questions

-

Youve just been introduced to the Black-Scholes option pricing model and want to give it a try, and would like to use it to calculate the value of a call option on TriHawk stock. Currently, TriHawks...

-

Consider the following data relevant to valuing a European-style call option on a nondividend paying stock: X = 40, RFR = 9 percent, T = six months (i.e., 0.5), and = 0.25. a. Compute the...

-

Assume that you have just been hired as a financial analyst by Tropical Sweets Inc., a mid-sized California company that specializes in creating exotic candies from tropical fruits such as mangoes,...

-

Linking every transport stakeholder together and ensuring seamless travel across Europe is a dream. With this objective, Amadeus, a leading global travel technology player, initiated a novel idea of...

-

Let M,N be subspaces of Rn. The perp operator acts on subspaces, we can ask how it interacts with other such operations. (a) Show that two perps cancel: (M) = M. (b) Prove that M N implies that N ...

-

Acting out the roles of telephone caller and receiver is an effective technique for improving skills. To give you such practice, your instructor will divide the class into pairs. Your Task. For each...

-

Q4 What are the challenges of international IT management?

-

As in Problem 1, Gladstone Corporation is about to launch a new product. Depending on the success of the new product, Gladstone may have one of four values next year: $150 million, $135 million, $95...

-

Bernie, the CEO of a U.S. manufacturer, is considering building a new manufacturing plant. He wants to take the request to the Board of Directors for approval but must first calculate the return on...

-

1. Why are DPAs criticized for bypassing the formal legal system? 2. Do the multi-billion-dollar settlements recovered prove that the DPA framework works? Why or why not? 3. Using internet research,...

-

You have been hired to value a new 25-year callable, convertible bond. The bond has a 4.8 percent coupon, payable annually. The conversion price is $9, and the stock currently sells for $3.21. The...

-

Childs Manufacturing has a discount bank loan that matures in one year and requires the firm to pay $2,950. Th e current market value of the firms assets is $3,400. The annual variance for the firms...

-

A large slab of aluminum has a thickness of 10 cm and is initially uniform in temperature at 400C. It is then suddenly exposed to a convection environment at 90C with h = 1400 W/m2 C. How long does...

-

What is the essential objective that scientists should pursue by striving to remove personal biases, a priori commitments, and emotional involvement from their investigations about the world?...

-

c) Critically review the use of ROA (Return on Assets) as an indicator for your purposes of how a company's resources are used to generate wealth, and how different companies might measure it in...

-

Find the volume of the solid obtained by rotating the region bounded by the given curves about the specified line. Sketch the region, the solid and a typical disk or washer. -2x 3. y = ex, y = 0, x =...

-

2. Given the list of scores: Score1 = [ 10, 40, 50, 54, 55, 59, 63, 65, 70, 71, 75, 77, 79, 80, 99] The one-sample T-test is used to test whether the mean of Score1 is statistically different from...

-

Find the area of the triangle having the given measurements. Round to the nearest square unit. 13) C=100, a 3 yards, b = 8 yards Use Heron's formula to find the area of the triangle. Round to the...

-

Results of the 2019 annual banking priorities survey of a sample of 220 bankers nationwide by Computer Services, Inc., available at bit.ly/2POHAlk, reveal insights on key areas of strategic focus and...

-

Define the term utility software and give two examples.

-

Explain what is meant by corporate social responsibility (CSR).

-

You are assessing the viability of two projects. Project A has a 25 per cent chance of losing 1,000,000, a 50 per cent chance of breaking even and a 25 per cent chance of making 1,000,000 profit....

-

Your company has just purchased 20 fork-lift trucks and has two payment options. The first option is to pay 100,000 every month for 12 months. The second option is to pay 1,200,000 at the end of the...

-

Calculate Social Security taxes, Medicare taxes and FIT for Jordon Barrett. He earns a monthly salary of $11,100. He is single and claims 1 deduction. Before this payroll, Barretts cumulative...

-

Bass Accounting Services expects its accountants to work a total of 26,000 direct labor hours per year. The company's estimated total indirect costs are $ 260,000. The company uses direct labor hours...

-

The Balance Sheet has accounts where the accountant must make estimates. Some situations in which estimates affect amounts reported in the balance sheet include: Allowance for doubtful accounts....

Study smarter with the SolutionInn App