For how many days could Earl Grey Golf Corp. continue to operate if its cash inflows were

Question:

For how many days could Earl Grey Golf Corp. continue to operate if its cash inflows were suddenly suspended?

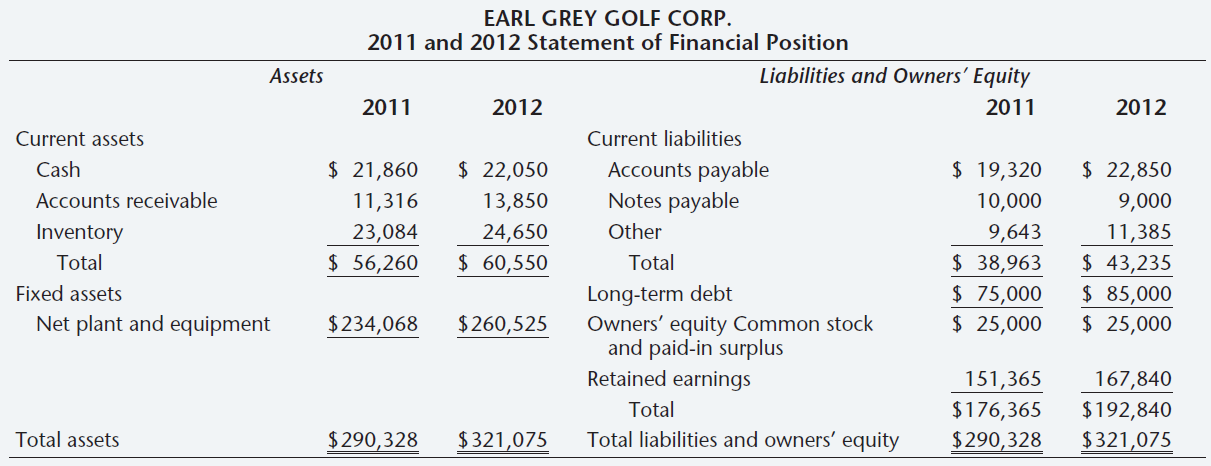

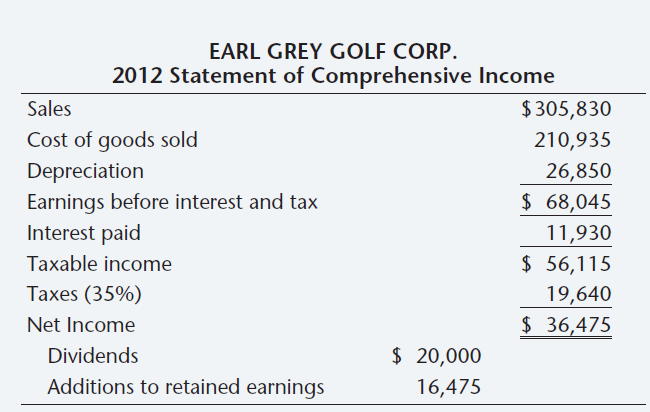

EARL GREY GOLF CORP. 2011 and 2012 Statement of Financial Position Liabilities and Owners' Equity Assets 2011 2011 2012 2012 Current liabilities Current assets $ 21,860 $ 22,050 $ 19,320 $ 22,850 Accounts payable Notes payable Other Total Cash Accounts receivable 11,316 10,000 9,643 $ 38,963 $ 75,000 $ 25,000 9,000 13,850 24,650 Inventory Total 23,084 $ 56,260 11,385 $ 43,235 $ 85,000 $ 25,000 $ 60,550 Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total Total liabilities and owners' equity Fixed assets Net plant and equipment $234,068 $260,525 151,365 $176,365 167,840 $192,840 Total assets $290,328 $321,075 $290,328 $321,075 EARL GREY GOLF CORP. 2012 Statement of Comprehensive Income Sales $ 305,830 Cost of goods sold 210,935 Depreciation 26,850 Earnings before interest and tax $ 68,045 Interest paid 11,930 Taxable income $ 56,115 Taxes (35%) 19,640 Net Income $ 36,475 Dividends $ 20,000 Additions to retained earnings 16,475

Step by Step Answer:

The number of days a company can operate if cash infl...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-0071051606

8th Canadian Edition

Authors: Stephen A. Ross, Randolph W. Westerfield

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Consider the supply chain planning implementation project depicted in Figure 16S-1. Suppose that the client has offered a $4,000 bonus to us if we can complete the project seven working days early....

-

For how many days in 2015 could Stowe continue to operate if its production were suspended? STOWE ENTERPRISES Sales Cost af goods sold Depreciation Earnings before interest and taxes Interest paid...

-

Construct the Du Pont identity for Earl Grey Golf Corp. EARL GREY GOLF CORP. 2011 and 2012 Statement of Financial Position Liabilities and Owners' Equity Assets 2011 2011 2012 2012 Current...

-

In Exercises 2324, find the standard form of the equation of each hyperbola satisfying the given conditions. Foci: (0, -4), (0, 4); Vertices: (0, -2), (0, 2)

-

a. Show the reagents required to form the primary alcohol. b. Which of the reactions cannot be used for the synthesis of isobutyl alcohol? c. Which of the reactions changes the carbon skeleton of the...

-

Solve each problem. See FIGURE 16 and use the fact that c 2 = a 2 - b 2 , where a 2 > b 2 . Round answers to the nearest tenth. The orbit of Venus around the sun (one of the foci) is an ellipse with...

-

8. What are the factors that can affect the success of a change?

-

St. Paul Lumber Company incurs a cost of $280 per hundred board feet in processing certain "rough-cut" lumber, which it sells for $320 per hundred board feet. An alternative is to produce a "finished...

-

Semi-annual payments on a 20 year, $4,000 Face Value Bond earning 1% should be O $30 O $10 O $20 $40

-

Julia Dumars is a licensed CPA. During the first month of operations of her business, Novak Corp., the following events and transactions occurred. May 1 Stockholders invested $21,400 cash in exchange...

-

Wolseley PLC has a net loss of 13,482 on sales of 138,793 (both in thousands of pounds). Does the fact that these figures are quoted in a foreign currency make any difference? Why? What was the...

-

The most recent financial statements for Marpole Inc. are shown here (assuming no income taxes): Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next years...

-

A car repair shop applies overhead to different service jobs using direct labor hours. The manager estimates that total indirect costs will be \($30,000\) and total direct labor hours will be 2,000....

-

Accounting Processes Identify the following processes as either measuring or communicating. a. Prepare financial statements for the entity b. Identify relevant economic activities of the entity c....

-

To estimate future values of the cost indices, one is tempted to assume that the average value for the year occurred at midyear (June 30-July 1) and that the linear fit to the recent data can be...

-

Reston Manufacturing Corporation produces a cosmetic product in three consecutive processes. The costs of Department | for May 2016 were as follows: Department | handled the following units during...

-

Financial Reporting Problem: Columbia Sportswear Company The financial statements for the Columbia Sportswear Company can be found in Appendix A at the end of this book. The following selected...

-

The retained earnings on a balance sheet are \(\$ 80,000\). Without seeing the rest of the balance sheet, can you conclude that stockholders should be able to receive a dividend in the amount of \(\$...

-

In Problem evaluate using a calculator. (Refer to the instruction book for your calculator to see how exponential forms are evaluated.) 827 -3/8

-

Calculate Total Contribution Margin for the same items. Total Revenue Total Variable Costs Total Contribution Margin $50.00 a. $116.00 $329.70 b. $275.00 $14,796.00 $7,440.00 c. $40,931.25 d....

-

Calculating EAR with Points you are looking at a one-year loan of $10,000. The interest rate is quoted as 9 percent plus three points. A point on a loan is simply 1 percent (one percentage point) of...

-

Calculating EAR with Points the interest rate on a one-year loan is quoted as 12 percent plus two points (see the previous problem). What is the EAR? Is your answer affected by the loan amount?

-

EAR versus APR Two banks in the area offer 30-year, $220,000 mortgages at 7.2 percent and charge a $1,500 loan application fee, however, the application fee charged by Insecurity Bank and Trust is...

-

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total...

-

Mrquered Mrquered

-

You plan to invest $10,00 today in an investment account earning 5% interest. You then plan to invest an additional $1,000 into this account each year for the next twenty years. How much money will...

Study smarter with the SolutionInn App