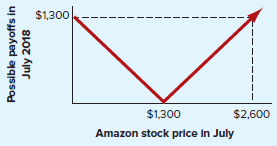

Look at Figure 23.8, which shows the possible future payoffs in July 2018 from a particular package

Question:

Look at Figure 23.8, which shows the possible future payoffs in July 2018 from a particular package of investments in Amazon options. Incidentally, this package of investments is called a ?straddle? by option buffs.

a. What package of investments would provide you with this set of payoffs?

b. How much would the package have cost you in January 2018?

c. Would it have made sense to hold this package if you thought that the price of Amazon stock was unlikely to change much?

$1,300 $1,300 $2,600 Amazon stock price In July Possible payoffs in July 2018 Explration Date Exercise Price Call Price Put Price April 2018 $1,200 $132.70 $ 31.10 1,300 73.20 70.10 1,400 33.00 134.20 July 2018 1,200 161.70 53.55 1,300 104.00 96.00 1,400 62.55 156.05 January 2019 1,200 210.00 88.05 1,300 155.35 133.25 1,400 112.00 190.00

Step by Step Answer:

a The package of investments that would provide the set o...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-1260566093

10th edition

Authors: Richard Brealey, Stewart Myers, Alan Marcus

Related Video

Stocks (also known as equities) are securities that represent ownership in a company. They are issued by companies to raise capital, and when an individual buys stocks, they become a shareholder in that company. Investing in stocks can be a way for individuals to potentially earn a return on their investment through dividends and capital appreciation. However, investing in stocks also carries a level of risk, as the value of the stock can fluctuate based on various factors such as the financial performance of the company and general market conditions. For companies, issuing stocks can be a way to raise funds for growth and expansion. When a company goes public by issuing an initial public offering (IPO), it can raise significant capital by selling ownership stakes to the public. Companies can also issue additional stock offerings to raise additional capital as needed.

Students also viewed these Business questions

-

Look at Figure 25.8, which shows the possible future payoffs in October 2014 from a particular package of investments involving TO stock and options. a. What package of investments would provide you...

-

Look at Figure 23.9, which shows the possible future payoffs in July 2018 from a particular package of investments in Amazon options. This package of investments is called a ?butterfly? by option...

-

Look at Figure 23.8, which shows the possible future payoffs in January 2011 from a particular package of investments. a. What package of investments would provide you with this set of payoffs? b....

-

How does unemployment behave over the business cycle?

-

One way to visualize a composition of functions is to use a web graph. Here's how you evaluate f (g(x)) for any value of x, using a web graph: Choose an x-value. Draw a vertical line from the x-axis...

-

Draw the shear and moment curves for beam ABC in Figure 5.18a. Also sketch the deflected shape. Rigid joints connect the vertical members to the beam. Elastomeric pad at C equivalent to a roller....

-

What factors might have tendency to limit a manager's ability to manipulate the elements involved in divisional profit calculations? LO.1

-

Suppose the five landscapers in your neighborhood form a cartel and decide to restrict output to 16 lawns each per week (for a total of 80 lawns in the entire market) in order to keep prices high....

-

10. Lifestyle regulation policies may best be deemed unethical as A. inconsistent with employees' rights to choose to engage in certain activities outside of the workplace pursuant to ethical egoism...

-

Develop a set of classes for a college to use in various student service and personnel applications. Classes you need to design include the following: PersonA Person contains a first name, last name,...

-

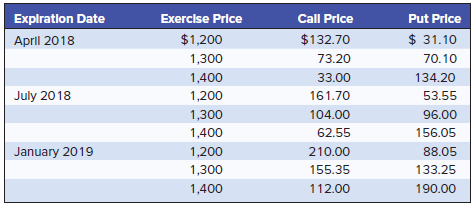

Look at the data in Table 23.2. a. What is the price of a call option with an exercise price of $1,300 and expiration in April 2018? What if expiration is in January 2019? b. Why do you think the...

-

Suppose that you hold a share of stock and a put option on that share with an exercise price of $100. What is the value of your portfolio when the option expires if: a. The stock price is below $100?...

-

Martin Company manufactures a powerful cleaning solvent. The main ingredient in the solvent is a raw material called Echol. Information concerning the purchase and use of Echol follows : Purchase of...

-

Exercise 11-5 Profit allocation in a partnership LO3 Dallas and Weiss formed a partnership to manage rental properties, by investing $198,000 and $242,000, respectively. During its first year, the...

-

Reading following articles and answer the questions: https://www.afr.com/technology/ai-is-coming-for-white-collar-jobs-gates-warns-20230123-p5cev7...

-

1. Citing an example in each case, briefly explain four types of book keeping errors which are not disclosed by trial balance 2. The trial balance extracted from the books of james as at 30 september...

-

Use the universal gravitation formula to determine which object has a larger effect on the Earth's motion through space: the Sun or the Moon. Explain how you are determining this, including very...

-

Pro Cycling Shop is a medium-size seller of the high-end bicycle. Since starting the company 15 years ago, Pro Cycling Shop has been a competitive company across Sarawak, Brunei, Kalimantan, and...

-

Anya calls Zara once each evening before she goes to bed. She calls Zaras mobile phone with probability 0.8 or her landline. The probability that Zara answers her mobile phone is 0.74, and the...

-

Design an experiment to demonstrate that RNA transcripts are synthesized in the nucleus of eukaryotes and are subsequently transported to the cytoplasm.

-

Suppose that you buy a 1 -year maturity bond with a coupon of 7% paid annually. If you buy the bond at its face value, what real rate of return will you earn if the inflation rate is a. 4%? b. 6%? c....

-

Suppose that you buy a TIPS (inflation-indexed) bond with a 1-year maturity and a coupon of 4% paid annually. If you buy the bond at its face value, and the inflation rate is 8%: a. What will be your...

-

Suppose that you buy a TIPS (inflation-indexed) bond with a 2-year maturity and a coupon of 4% paid annually. If you buy the bond at its face value, and the inflation rate is 8% in each year: a. What...

-

Ray Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's Flexible Budget Performance Report....

-

Problem 1 5 - 5 ( Algo ) Lessee; operating lease; advance payment; leasehold improvement [ L 0 1 5 - 4 ] On January 1 , 2 0 2 4 , Winn Heat Transfer leased office space under a three - year operating...

-

Zafra and Stephanie formed an equal profit- sharing O&S Partnership during the current year, with Zafra contributing $100,000 in cash and Stephanie contributing land (basis of $60,000, fair market...

Study smarter with the SolutionInn App