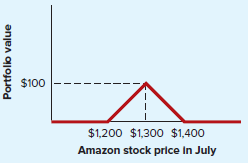

Look at Figure 23.9, which shows the possible future payoffs in July 2018 from a particular package

Question:

Look at Figure 23.9, which shows the possible future payoffs in July 2018 from a particular package of investments in Amazon options. This package of investments is called a ?butterfly? by option buffs.

a. What package of investments would provide you with this set of payoffs?

b. How much would the package have cost you in January 2018?

c. Would it have made sense to hold this package if you thought that the price of Amazon stock was unlikely to change much?

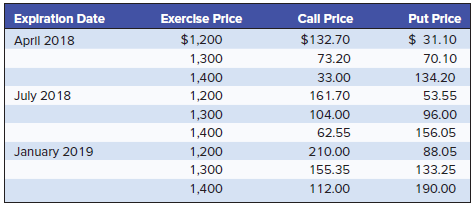

Explration Date Exercise Price Call Price Put Price $ 31.10 $1,200 $132.70 April 2018 70.10 1,300 73.20 1,400 33.00 134.20 July 2018 1,200 161.70 53.55 1,300 104.00 96.00 1,400 156.05 62.55 January 2019 88.05 1,200 210.00 155.35 1,300 133.25 1,400 112.00 190.00 $100 $1,200 $1,300 $1,400 Amazon stock price In July Portfolio value

Step by Step Answer:

a Buy the 1200 exercise call Sell two ...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-1260566093

10th edition

Authors: Richard Brealey, Stewart Myers, Alan Marcus

Related Video

Stocks (also known as equities) are securities that represent ownership in a company. They are issued by companies to raise capital, and when an individual buys stocks, they become a shareholder in that company. Investing in stocks can be a way for individuals to potentially earn a return on their investment through dividends and capital appreciation. However, investing in stocks also carries a level of risk, as the value of the stock can fluctuate based on various factors such as the financial performance of the company and general market conditions. For companies, issuing stocks can be a way to raise funds for growth and expansion. When a company goes public by issuing an initial public offering (IPO), it can raise significant capital by selling ownership stakes to the public. Companies can also issue additional stock offerings to raise additional capital as needed.

Students also viewed these Business questions

-

Look at Figure 25.8, which shows the possible future payoffs in October 2014 from a particular package of investments involving TO stock and options. a. What package of investments would provide you...

-

Look at Figure 23.8, which shows the possible future payoffs in July 2018 from a particular package of investments in Amazon options. Incidentally, this package of investments is called a ?straddle?...

-

Look at Figure 23.8, which shows the possible future payoffs in January 2011 from a particular package of investments. a. What package of investments would provide you with this set of payoffs? b....

-

The North American and European continents are moving apart at a rate of about 3 cm/y. At this rate how long will it take them to drift 500 km farther apart than they are at present?

-

Which of these graphs represent functions? Why or why not? a. b. c.

-

Select one influencer or celebrity that you follow online. Describe how they have used marketing to build their brand.

-

What is meant by a potential conflict of interests between divisional responsibility reporting and effective decision-making? LO.1

-

Suppose Procter & Gamble (P&G) learns that a relatively new startup company Method (www. methodhome.com) is gaining market share with a new laundry detergent in West Coast markets. In response, P&G...

-

Jim inherits stock ( a capital asset ) from his brother, who died in March 2 0 2 3 , when the property had a $ 2 0 . 7 million FMV . This property is the only property included in his brother s gross...

-

What is net force on the dipole inside the capacitor if the plates are separated by 1 centimeter and the magnitude of the charges is 1 micro-coulomb? 16 V 202 4uf 2

-

Look at the data in Table 23.2. a. What is the price of a call option with an exercise price of $1,300 and expiration in April 2018? What if expiration is in January 2019? b. Why do you think the...

-

Suppose that you hold a share of stock and a put option on that share with an exercise price of $100. What is the value of your portfolio when the option expires if: a. The stock price is below $100?...

-

A faucet leaks 1 oz of water per minute. (a) How many gallons of water are wasted in a year? (A gallon contains 128 oz.) (b) If water costs $11.20 per 1000 gal, how much additional money is being...

-

Star Trek LLC has 8,000 bonds, two million shares of preferred stock outstanding and seven million shares of common stock outstanding. If the common shares are selling for $17 per share, the...

-

So the component of the flow velocity that is perpendicular to the isobar in cm/s is: V =2V cos(0)=2(10/(1+2 sin(0))) cos(0) V (10)/[1+2(1) sin(90)] = V = 3.3cm/s

-

2. The CIBC stock price was very volatile today. a. Using the website below, what did the price of CIBC shares end the day at ? CM.TO: Canadian Imperial Bank of Commerce - Yahoo Finance b. In a brief...

-

Answer the following according to Florida rules: Abigail Atlas was chatting quietly in the hall outside Courtroom 14-1 with Mariel Topher, an employee of the Hopper Law Firm that was representing...

-

Draw Free body diagrams for the following 32 situations and write the appropriate x- and y- equations, using the diagram and title to help you (do not solve). Some of the material you have not...

-

A coin is biased such that the probability that three tosses all result in heads is 125/512. Find the probability of obtaining no heads with three tosses of the coin.

-

An auto-parts manufacturer is considering establishing an engineering computing center. This center will be equipped with three engineering workstations each of which would cost $25,000 and have a...

-

Consider three bonds with 8% coupon rates, all making annual coupon payments and all selling at face value. The short-term bond has a maturity of 4 years, the intermediate-term bond has maturity 8...

-

A 2-year maturity bond with face value of $1,000 makes annual coupon payments of $80 and is selling at face value. What will be the rate of return on the bond if its yield to maturity at the end of...

-

A bond is issued with a coupon of 4% paid annually, a maturity of 30 years, and a yield to maturity of 7%. What rate of return will be earned by an investor who purchases the bond for $627.73 and...

-

What general conclusions can you draw about your companys liquidity, solvency and productivity based on your ratio calculations. Working Capital 2017 = $9,994 M 2016 = $10,673 M Current Ratio 2017 =...

-

Tami Tyler opened Tami's Creations, Incorporated, a small manufacturing company, at the beginning of the year. Getting the company through its first quarter of operations placed a considerable strain...

-

5. The current spot exchange rate is 0.95/$ and the three-month forward rate is 0.91/$. Based on your analysis of the exchange rate, you are pretty confident that the spot exchange rate will be...

Study smarter with the SolutionInn App