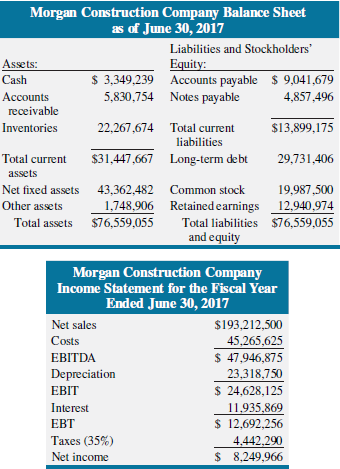

The financial statements for the year ended June 30, 2017, are given below for Morgan Construction Company.

Question:

The financial statements for the year ended June 30, 2017, are given below for Morgan Construction Company. The firm’s sales are projected to grow at a rate of 25 percent next year, and all financial statement accounts will vary directly with sales. Based on that projection, develop a pro forma balance sheet and an income statement for the 2018 fiscal year.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Morgan Construction Company Balance Sheet as of June 30, 2017 Liabilities and Stockholders' Assets: Equity: $ 3,349,239 Accounts payable $ 9,041,679 5,830,754 Notes payable Cash Accounts 4,857,496 receivable 22,267,674 Total current Inventories $13,899,175 liabilities $31,447,667 Long-term debt Total current 29,731,406 assets Net fixed assets 43,362,482 Common stock 19,987,500 Other assets 1,748,906 Retained earnings 12,940,974 Total assets $76,559,055 Total liabilities $76,559,055 and equity Morgan Construction Company Income Statement for the Fiscal Year Ended June 30, 2017 Net sales $193,212,500 Costs 45,265,625 $ 47,946,875 EBITDA Depreciation 23,318,750 $ 24,628,125 11,935,869 $ 12,692,256 EBIT Interest EBT Taxes (35%) 4,442,290 $ 8,249,966 Net income

Step by Step Answer:

Morgan Construction Company x Pro Forma Balance Sheet for Year Ended June 30 2017 2018 2017 2...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-1119371403

4th edition

Authors: Robert Parrino, David S. Kidwell, Thomas Bates

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

The financial statements for the year ended June 30, 2011, are given below for Morgan Construction Company. The firms sales are projected to grow at a rate of 25 percent next year, and all financial...

-

Munson Communications Company management has just reported earnings for the year ended June 30, 2017. Below are the firms income statement and balance sheet. The company had a 55 percent dividend...

-

Explain the relation between each pair of currencies. Spot Rate Forward Rate a. $1.655/ $1.6001/ b. 104.45/$ 102.33/$ c. C$1.1121/$ C$1.0940/$

-

Suppose you own an outdoor recreation company and you want to purchase all-terrain vehicles (ATVs) for your summer business and snowmobiles for your winter business. Your budget for new vehicles this...

-

Christina Haley of San Marcos, Texas, age 61, recently suffered a severe stroke. She was in intensive care for 12 days and was hospitalized for 18 more days. After being discharged from the hospital,...

-

1. Suppose the banking system currently has $300 billion in reserves; the reserve requirement is 10 percent; and excess reserves amount to $3 billion. What is the level of deposits? a. $3,300 billion...

-

How Can We Study Organizational Culture? (pp. 483491)

-

Charlene owns a 70% interest in Maupin Mopeds, which is organized as a partnership. She wants to open another business and needs office space for it. She has Maupin distribute a building worth...

-

Your answer must be based on Companies Act 2016 Malaysia, cases or equivalent legislation/ laws.( relate the law to situations pertaining to separate legal entity and company constitution ) During...

-

1. How many units would you forecast for a day in which the high temperature is 89 degrees? 2. How many units would you forecast for a day in which the high temperature is 41 degrees? 3. Based on the...

-

Maryland Micro Brewers generated revenues of $12,125,800 with a 72 percent capital intensity ratio during the year ended September 30, 2017. Its net income was $873,058. With the introduction of a...

-

The market value of Whole Foods stock is currently $53.73 per share, and the annual risk-free rate is 3 percent. A three-month call option on the stock with a strike price of $55 sells for $2.15....

-

O??Malley Corporation was incorporated and began business on January 1, 2012. It has been successful and now requires a bank loan for additional working capital to finance expansion. The bank has...

-

Which industries gain and which industries lose from the availability of cheap natural gas produced from shale deposits? Joseph Schumpeter, an Austrian-born economist who emigrated to the United...

-

Did the value of the Canadian dollar rise or fall between Tuesday and Wednesday?

-

As vice president for community relations, you want to explore the possibility of developing service learning programs with several nearby colleges and universities. Using Figure 2.5, suggest the...

-

Your organization initiated a project to raise money for an important charity. Assume that there are 1,000 people in your organization. Also, assume that you have six months to raise as much money as...

-

A \(20-\mathrm{cm}\)-long rod, with uniform linear charge density \(100 \mathrm{nC} / \mathrm{cm}\), is set up symmetrically on the \(x\) axis. What are the magnitude and direction of the electric...

-

Using table A.1, calculate the following future values: 1. $10 000 invested at 8% for 5 years, compounded yearly 2. $10 000 invested at 8% for 5 years, compounded half-yearly 3. $10 000 invested at...

-

Tanaka Company's cost and production data for two recent months included the following: March April Production (units).........300................600 Rent.....................$1,800............$1,800...

-

Net Present Value Concerning NPV: a. Describe how NPV is calculated, and describe the information this measure provides about a sequence of cash flows. What is the NPV criterion decision rule? b. Why...

-

Net Present Value Concerning NPV: a. Describe how NPV is calculated, and describe the information this measure provides about a sequence of cash flows. What is the NPV criterion decision rule? b. Why...

-

Net Present Value Concerning NPV: a. Describe how NPV is calculated, and describe the information this measure provides about a sequence of cash flows. What is the NPV criterion decision rule? b. Why...

-

Strawberry Inc. has historically been an all-equity firm. The analyst expects EBIT to be $1.5B in perpetuity starting one year from now. The cost of equity for the company is 11.5% and the tax rate...

-

Guzman company received a 60- day, 5 % note for 54,000 dated July 12 from a customer on account. Determine the due date on note. Determine the maturity value of the note and journalize the entry of...

-

Jeannie is an adjunct faculty at a local college, where she earned $680.00 during the most recent semimonthly pay period. Her prior year-to-date pay is $18,540. She is single and has one withholding...

Study smarter with the SolutionInn App