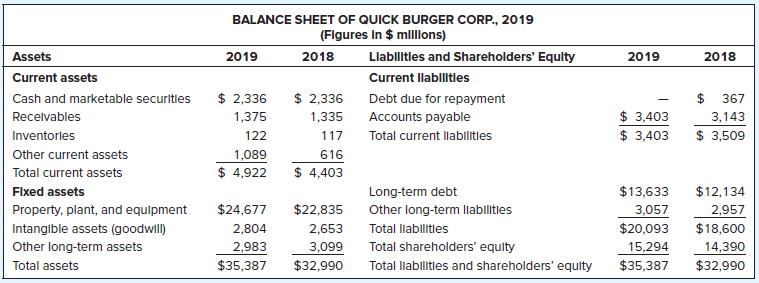

The following table shows an abbreviated income statement and balance sheet for Quick Burger Corporation for 2019.

Question:

The following table shows an abbreviated income statement and balance sheet for Quick Burger Corporation for 2019.

INCOME STATEMENT OF QUICK BURGER CORP., 2019(Figures in $ millions)Net sales..............................................................................................$27,567Costs.......................................................................................................17,569Depreciation............................................................................................1,402Earnings before interest and taxes (EBIT).........................................$ 8,596Interest expense.........................................................................................517Pretax income..........................................................................................8,079Federal plus other taxes.........................................................................2,614Net income............................................................................................$ 5,465

In 2019 Quick Burger had capital expenditures of $3,049.

a. Calculate Quick Burger?s free cash flow in 2019.

b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.)

c. What would the company?s free cash flow have been if it was all-equity financed?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Free Cash Flow

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Fundamentals of Corporate Finance

ISBN: 978-1260566093

10th edition

Authors: Richard Brealey, Stewart Myers, Alan Marcus