Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in

Question:

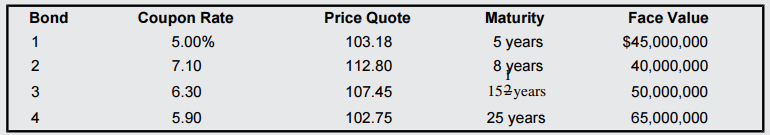

Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the following table. If the corporate tax rate is 22 percent, what is the aftertax cost of the company’s debt?

Bond Price Quote 103.18 Coupon Rate 5.00% Maturity Face Value 5 years $45,000,000 40,000,000 8 years 152years 7.10 112.80 107.45 3 6.30 50,000,000 25 years 4 5.90 102.75 65,000,000

Step by Step Answer:

To find the aftertax cost of debt for the company we need to find the weighted average of the four d...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-1260153590

12th edition

Authors: Stephen M. Ross, Randolph W Westerfield, Robert R. Dockson, Bradford D Jordan

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Business questions

-

Minder Industries stock has a beta of 1.08. The company just paid a dividend of $.65, and the dividends are expected to grow at 4 percent. The expected return on the market is 10.5 percent, and...

-

Lucas Corp. has a debt-equity ratio of .65. The company is considering a new plant that will cost $51 million to build. When the company issues new equity, it incurs a flotation cost of 7 percent....

-

Bell Hill Mfg. is considering a rights offer. The company has determined that the ex-rights price would be $63. The current price is $68 per share, and there are 26 million shares outstanding. The...

-

Draw a simple undirected graph G that has 12 vertices, 18 edges, and 3 connected components.

-

Determine if each set is linearly independent in the natural space. (a) (b) {(1 3 1), (-1 4 3), (-1 11 7)} (c) 0 120 04 0 0 2 1

-

In a particular factory, a shift supervisor is a salaried employee who supervises a shift. In addition to a salary, the shift supervisor earns a yearly bonus when his or her shift meets production...

-

Income statement and balance sheet data for The Athletic Attic are provided below. Required: 1. Calculate the following risk ratios for 2021 and 2022: a. Receivables turnover ratio. c. Current ratio....

-

Suppose Leonard Krauss places an order to buy 100 shares of Google. Explain how the order will be processed if its a market order. Would it make any difference if it had been a limit order? Explain.

-

ILLUULE Volume 1 SHERIDAN COLLEGE TRAI ALGAR CAMPUSE Mese, Interme 120 W Teme: 03:00 / 40 min Question 23 Sheffield Ltd. purchased a patent on September 1, 2017 for $41,600. At the time of purchase,...

-

a. What is the percentage depletion amount if the IDCs are expensed? b. What is the percentage depletion amount if the IDCS are capitalized? c. What is the depletion deduction amount assuming that...

-

Being Human, Inc., recently issued new securities to finance a new TV show. The project cost $35 million, and the company paid $2.2 million in flotation costs. In addition, the equity issued had a...

-

Pearl Corp. is expected to have an EBIT of $1.8 million next year. Depreciation, the increase in net working capital, and capital spending are expected to be $155,000, $75,000, and $115,000,...

-

Write up a two-column cash book for a second-hand bookshop from the following: 2013 Nov 1 Balance brought forward from last month: Cash 295; Bank 4,240. 2 Cash sales 310. 3 Took 200 out of the cash...

-

Let two planes be given by 2x-y+z = 8 and z = x+y-5 (a) Find the angle between the two planes. Leave your answer in degrees and round to the nearest tenth. (b) Find the vector equation of the line of...

-

9-2. The profile of a gear tooth shown in Fig. P9.2 is approximated by the trigonometric equation y(x) = a. Estimate the area A using eight rectangles of equal width A x = 1/8, b. Calculate the exact...

-

tube is hinged to a rotating base as shown in Fig. 4. At the instant shown, the base rotates about the z axis with a constant angular velocity ! 1 = 2 rad/s. At the same instant, the 2 tube rotates...

-

Find the limit analytically. -7x2+5x-10 lim 0 9x+13x+11 Find the limit analytically. lim +80 4x-13 5x+6x-11

-

Write a recursive function for the running time T(n) of the function given below. Prove using the iterative method that T(n) = (n). function( int n) { if(n=1) return; for(int i = 1; i

-

What are storage area networks? What flexibility and advantages do they offer?

-

Grace is training to be an airplane pilot and must complete five days of flying training in October with at least one day of rest between trainings. How many ways can Grace schedule her flying...

-

M&M and Taxes in the previous question, suppose the corporate tax rate is 35 percent. What is EBIT in this case? What is the WACC? Explain.

-

Calculating WACC Maxwell Industries has a debt-equity ratio of 1.5. Its WACC is 11 percent, and its cost of debt is 8 percent. The corporate tax rate is 35 percent. a. What is Maxwells cost of equity...

-

Calculating WACC second Base Corp has no debt but can borrow at 7.5 percent. The firms WACC is currently 10 percent, and the tax rate is 35 percent. a. What is Second Bases cost of equity? b. If the...

-

ACC 2 0 2 Milestone One: Operational Costs Data Appendix You plan to open a small business for manufacturing pet collars, leashes, and harnesses. You have found a workshop space you can use for...

-

Explain the following: Understand the PPE acquisition (or investing) cycle and related significant transactions and source documents Understand the relevant assertions/objectives about PPE balances...

-

Problem 3 Progress Company acquired 6 0 % of Stall Corporation on 1 2 0 2 0 . Fair values of Stall's assets and liabilities approximated book values on that date. Progress uses the initial value...

Study smarter with the SolutionInn App