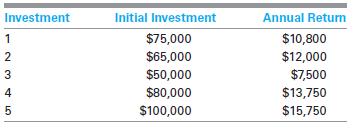

19. Aerotron Radio Inc. has $250,000 available and its engineering staff has proposed the following divisible investments.

Question:

19. Aerotron Radio Inc. has $250,000 available and its engineering staff has proposed the following divisible investments. With each, Aerotron can exit at the end of its planning horizon of 5 years and have its initial investment returned.

In addition, each year Aerotron will receive the annual return shown below.

MARR is 12%.

a. Determine the optimum portfolio, including which investments are fully or partially (if partial, give percentage) selected. You may use Excel®;

do not use SOLVER.

b. Determine the optimum portfolio and its PW, specifying which investments are fully or partially (give percentage) selected using (1) the current limit on investment capital, (2) plus 20%, and (3) minus 20%. Use Excel®

and SOLVER.

c. Determine the optimum portfolio and its PW, specifying which investments are fully or partially (give percentage) selected using (1) the current MARR, (2) plus 20%, and (3) minus 20%. Use Excel® and SOLVER.

d. Determine the optimum investment portfolio and its PW when investments 1, 2, and 3 are divisible and investments 4 and 5 are indivisible. Use Excel® and SOLVER.

Step by Step Answer:

Fundamentals Of Engineering Economic Analysis

ISBN: 9781118414705

1st Edition

Authors: John A. White, Kellie S. Grasman, Kenneth E. Case, Kim LaScola Needy, David B. Pratt