Mount Manufacturing Company produces industrial and publicsafety shirts. As is done in most apparel manufacturing, the cloth

Question:

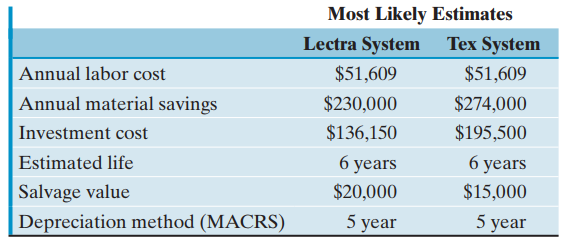

The firm€™s marginal tax rate is 40%, and the interest rate used for project evaluation is 12% after taxes.

(a) Based on the most likely estimates, which alternative is better?

(b) Suppose that the company estimates the material savings during the first year for each system on the basis of the following probability distributions:

Lectra System

Material Savings Probability

$150,000....................................0.25

$230,000....................................0.40

$270,000....................................0.35

Tex System

Material Savings Probability

$200,000....................................0.30

$274,000....................................0.50

$312,000....................................0.20

Further assume that the annual material savings for both Lectra and Tex are statistically independent. Compute the mean and variance for the equivalent annual value of operating each system.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer: