American Laser, Inc., reported the following account balances on January 1. The company entered into the following

Question:

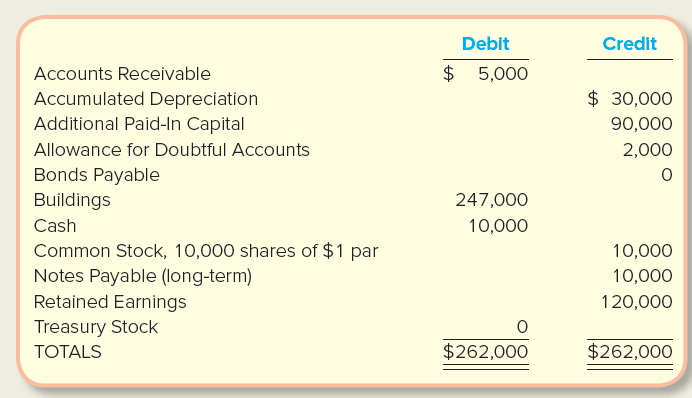

American Laser, Inc., reported the following account balances on January 1.

The company entered into the following transactions during the year.

Jan. 15 Issued 5,000 shares of $1 par common stock for $50,000 cash.

Jan. 31 Collected $3,000 from customers on account.

Feb. 15 Reacquired 3,000 shares of $1 par common stock into treasury for $33,000 cash.

Mar. 15 Reissued 2,000 shares of treasury stock for $24,000 cash.

Aug. 15 Reissued 600 shares of treasury stock for $4,600 cash.

Sept. 15 Declared (but did not yet pay) a $1 cash dividend on each outstanding share of common stock.

Oct. 1 Issued 100, 10-year, $1,000 bonds, at a quoted bond price of 101.

Oct. 3 Wrote off a $2,000 balance due from a customer who went bankrupt.

Dec. 29 Recorded $230,000 of service revenue, all of which was collected in cash.

Dec. 30 Paid $200,000 cash for this year’s wages through December 31. Ignore payroll taxes and payroll deductions.

Dec. 31 Calculated $10,000 of depreciation for the year to be recorded. (Ignore accrual adjustments for interest and income taxes.)

Required:

1. Analyze the effects of each transaction on total assets, liabilities, and stockholders’ equity.

2. Prepare journal entries to record each transaction.

3. Enter the January 1 balances into T-accounts, post the journal entries from requirement 2, and determine ending balances.

4. Prepare a closing journal entry for the income statement accounts, assuming the events on December 29–31 were the only transactions to affect income statement accounts.

5. Prepare the closing entry for Dividends.

6. Prepare a classified balance sheet at December 31.

7. Calculate the debt-to-assets ratio at January 1 and December 31. Does the company rely more (or less) on debt financing at the end of the year than at the beginning of the year?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259864230

6th edition

Authors: Fred Phillips, Robert Libby, Patricia Libby