During 2017, Rayon Corporation disposed of two different assets. On January 1, 2017, prior to disposal of

Question:

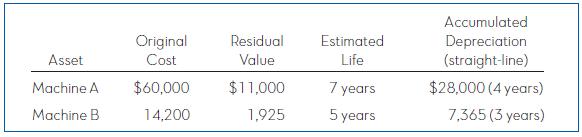

During 2017, Rayon Corporation disposed of two different assets. On January 1, 2017, prior to disposal of the assets, the accounts reflected the following:

The machines were disposed of in the following ways:

a. Machine A: This machine was sold on January 2, 2017, for $33,500 cash.

b. Machine B: On January 2, 2017 this machine suffered irreparable damage from an accident and was removed immediately by a salvage company at no cost.

Required:

1. Give the journal entries related to the disposal of each machine at the beginning of 2017.

2. Explain the accounting rationale for the way in which you recorded each disposal.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh