Ethan Allen Interiors Inc. is a leading manufacturer and retailer of home furnishings in the United States

Question:

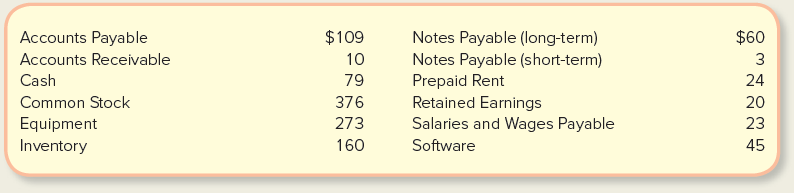

Ethan Allen Interiors Inc. is a leading manufacturer and retailer of home furnishings in the United States and abroad. The following is adapted from Ethan Allen’s September 30, 2016, trial balance. (The amounts shown represent millions of dollars.)

Assume that the following events occurred in the following quarter.

a. Paid $30 cash for additional inventory.

b. Issued additional shares of common stock for $20 in cash.

c. Purchased equipment for $170; paid $60 in cash and signed a note to pay the remaining $110 in two years.

d. Signed a short-term note to borrow $10 cash.

e. Conducted negotiations to purchase a sawmill, which is expected to cost $36.

Required:

1. Calculate Ethan Allen’s current ratio at September 30, 2016, prior to the transactions listed above. Based on this calculation and the analysis of TripAdvisor’s current ratio in the chapter, indicate which company is in a better position to pay liabilities as they come due in the next year.

2. Analyze transactions (a)–(e) to determine their effects on the accounting equation. Use the format shown in the demonstration case.

3. Record the transaction effects determined in requirement 2 using journal entries.

4. Using the September 30, 2016, ending balances as the beginning balances for the October–December 2016 quarter, summarize the journal entry effects from requirement 3. Use T-accounts if this requirement is being completed manually; if you are using the general ledger tool in Connect, the journal entries will have been posted automatically to general ledger accounts that are similar in appearance to Exhibit 2.9.

5. Explain your response to event (e).

6. Prepare a classified balance sheet at December 31, 2016.

7. Use your response to requirement 6 to calculate Ethan Allen’s current ratio after the transactions listed in (a)–(e). Based on this calculation and the calculation in requirement 1, indicate whether the above transactions increase or decrease the company’s ability to pay current liabilities as they come due in the next year.

8. As of December 31, 2016, has the financing for Ethan Allen’s investment in assets primarily come from liabilities or stockholders’ equity?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259864230

6th edition

Authors: Fred Phillips, Robert Libby, Patricia Libby