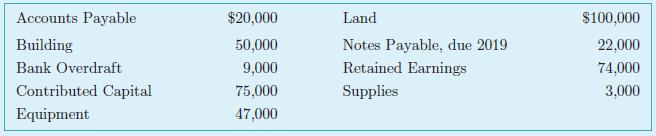

Fruity Farms was incorporated as a private company on January 1, 2017. The companys accounts included the

Question:

Fruity Farms was incorporated as a private company on January 1, 2017. The company’s accounts included the following at January 31, 2017:

During the month of February, the company had the following activities:

a. Paid a dividend to shareholders of $15,000

b. Repaid $10,000 cash to a local bank

c. Issued 500 shares for $50,000 cash

d. Purchased equipment for $30,000, paying $3,000 in cash and signing a note due in six months for the balance

e. Purchased supplies for $3,000 on account

Required:

1. Analyze transactions (a) through (e) to determine their effects on the accounting equation.

2. Record the transaction effects determined in requirement 1 using a journal entry format.

3. Summarize the journal entry effects from requirement 2 using T-accounts.

4. Prepare a classified balance sheet at February 28, 2017.

5. As of February 28, 2017, has the financing for Fruity Farm’s investment in assets primarily come from liabilities or from shareholders’ equity?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh