Blockhead and Sons is a motor vehicle repair centre specializing in engine repair. At the end of

Question:

Blockhead and Sons is a motor vehicle repair centre specializing in engine repair. At the end of the most recent year, 2016, the accounting records reported total assets of $746,000 and total liabilities of $534,000. During the current year, 2017, the following summarized events occurred:

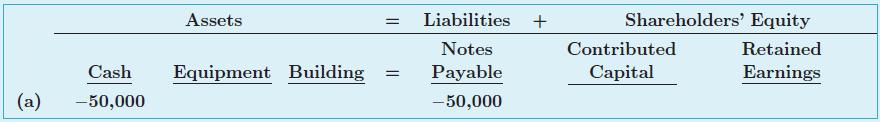

a. Repaid $50,000 cash on a bank note borrowed in a previous year

b. Bought a tow truck (equipment) from a supplier for $25,000; signed a one-year note for the liability

c. Disposed of a computer that was obsolete (net book value of zero) by turning it into a salvage centre; no proceeds from the disposal

d. Purchased shop equipment for $100,000; paid cash

e. Paid a $50,000 cash dividend to the shareholders

f. Made a $100,000 down payment on a $500,000 building; signed a forty-year note for the remainder

g. Borrowed $100,000 cash from the bank and signed a ten-year note

Required:

1. Complete the spreadsheet that follows, using plus (+) for increases and minus (−) for decreases for each account. The first transaction is given as an example.

2. Did you include event (c) in the spreadsheet? Why?

3. Based on beginning balances plus the completed spreadsheet, provide the following amounts (show computations):

a. Total assets at the end of the year

b. Total liabilities at the end of the year

c. Total shareholders’ equity at the end of the year

4. As of December 31, 2017, has the financing for Blockhead and Sons’s investment in assets primarily come from liabilities or from shareholders’ equity?

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh