Green Construction Inc. has poor internal control. Recently, Jean Ouimet, the owner, has suspected the bookkeeper of

Question:

Green Construction Inc. has poor internal control. Recently, Jean Ouimet, the owner, has suspected the bookkeeper of stealing. Here are some details of the business's cash position at June 30, 2020

a. The Cash account shows a balance of \(\$ 10,402\). This amount includes a June 30 deposit of \(\$ 3,794\) that does not appear on the June 30 bank statement.

b. The June 30 bank statement shows a balance of \(\$ 8,224\). The bank statement lists a \(\$ 200\) bank collection, an \(\$ 8\) service charge, and a \(\$ 36\) NSF cheque. The bookkeeper has not recorded any of these items

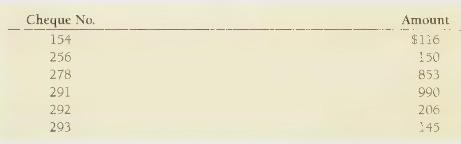

c. At June 30 , the following cheques are outstanding.

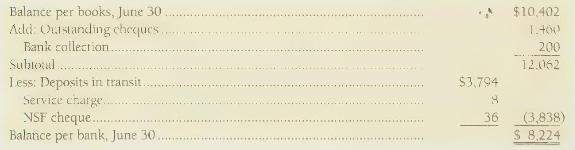

d. The bookkeeper records all incoming cash and makes bank deposits. He also reconciles the monthly bank statement. Here is his June 30 reconciliation:

{Requirements}

1. Prepare the bank reconciliation. There are no bank or book errors.

2. Using the facts provided, identify the information that would be relevant to determining whether or not the bookkeeper has stolen cash from the business.

3. Recommend to Ouimet any changes needed to prevent this from happening again.

1. Outstanding cheques Classify bank reconciliation items 2. Bank error: The bank credited our account for a deposit made by another bank customer.

3. Service charge 4. Deposits in transit 5. NSF cheque 6. Bank collection of a note receivable on our behalf 7. Book error: We debited Cash for \(\$ 100\). The correct debit was \(\$ 1,000\).

Classify each item as

(a) an addition to the bank balance,

(b) a subtraction from the bank balance,

(c) an addition to the book balance, or

(d) a subtraction from the book balance.

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin