Lisa Company had 100,000 outstanding common shares. On January 10, 2017, Marg Company purchased a block of

Question:

Lisa Company had 100,000 outstanding common shares. On January 10, 2017, Marg Company purchased a block of these shares in the open market at $20 per share, with the intent of holding the shares for a long time. At the end of 2017, Lisa reported net income of $300,000 and cash dividends of $0.60 per share. At December 31, 2017, Lisa Company shares were selling at $18 per share.

Required:

1. This problem involves two separate cases. For each case (shown in the table below), identify the method of accounting that Marg Company should use. Explain why.

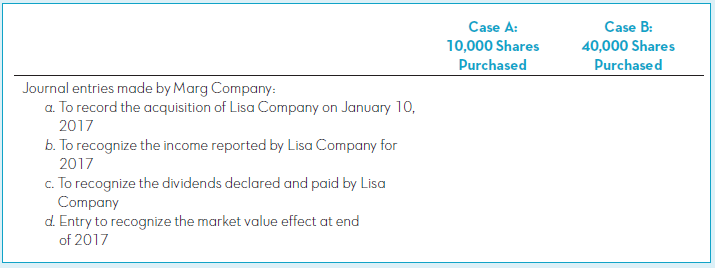

2. Give the journal entries for Marg Company at the dates indicated for each of the two independent cases. If no entry is required, explain why. Use the following format:

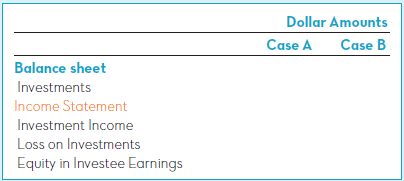

3. Complete the following schedule to show the separate amounts that should be reported on the 2017 financial statements of Marg Company:

4. Explain why assets and investment income for the two cases are different.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh