Bart Company had 30,000 outstanding common shares for $10 per share. On January 1, 2017, Homer Company

Question:

Bart Company had 30,000 outstanding common shares for $10 per share. On January 1, 2017, Homer Company purchased some of these shares at $25 per share, with the intent of holding them for a long time. At the end of 2017, Bart Company reported the following: net income, $50,000, and cash dividends declared and paid during the year, $25,500. The market value of Bart Company shares at the end of 2017 was $22 per share.

Required:

1. This problem involves two separate cases. For each case (shown in the table below), identify the method of accounting that Homer Company should use. Explain why.

TIP: Divide the number of shares purchased by the number outstanding to determine the percentage of ownership.

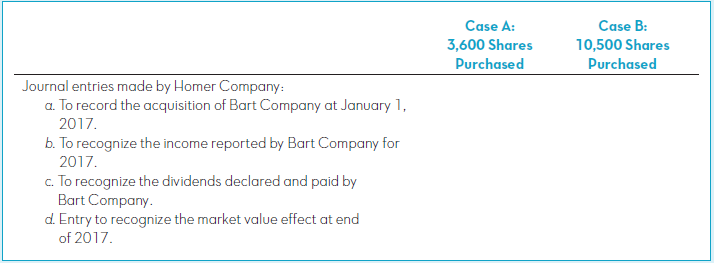

2. Give the journal entries for Homer Company at the dates indicated for each of the two independent cases. If no entry is required, explain why. Use the following format:

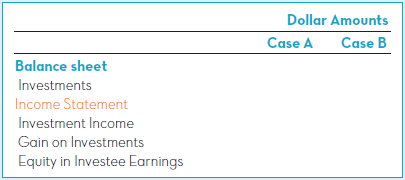

3. Complete the following schedule to show the separate amounts that should be reported on the 2017 financial statements of Homer Company:

4. Explain why assets and investment income for the two cases are different.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh