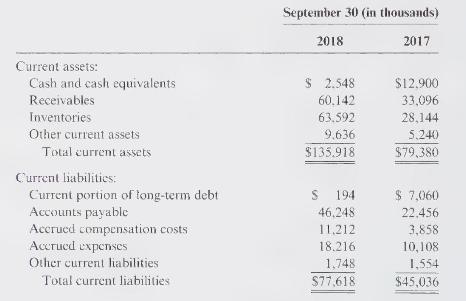

Ratio Analysis Consider the following information taken from Niagara Water Slide's (NWS's) financial statements: Also, NWS's operating

Question:

Ratio Analysis Consider the following information taken from Niagara Water Slide's (NWS's) financial statements:

Also, NWS's operating cash flows were \(\$ 25,658\) and \(\$ 29,748\) in 2018 and 2017 , respectively. Note: Round all answers to two decimal places.

\section*{Required:}

1. Calculate NWS's current ratio for 2018 and 2017.

2. Calculate NWS's quick ratio for 2018 and 2017.

3. Calculate NWS's cash ratio for 2018 and 2017.

4. Calculate NWS's operating cash flow ratio for 2018 and 2017.

5. Calculate NWS's trade payable turnover ratio for 2018. Assume cost of goods sold is \(\$ 75,000\).

6. CONCEPTUAL CONNECTION Provide some reasons why NWS's liquidity may be considered to be improving and some reasons why it may be worsening.

\section*{Case

Step by Step Answer:

Cornerstones Of Financial Accounting

ISBN: 9780176707125

2nd Canadian Edition

Authors: Jay Rich, Jefferson Jones, Maryanne Mowen, Don Hansen, Donald Jones, Ralph Tassone