Red Hat, Inc., is a software development company that recently reported the following amounts (in thousands) in

Question:

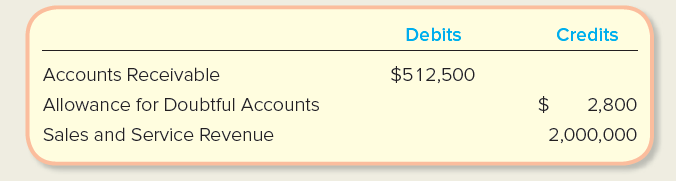

Red Hat, Inc., is a software development company that recently reported the following amounts (in thousands) in its unadjusted trial balance as of February 29, 2016.

Required:

1. Assume Red Hat uses ¼ of 1 percent of revenue to estimate its bad debt expense for the year. Prepare the adjusting journal entry required at February 29 for recording Bad Debt Expense.

2. Assume instead that Red Hat uses the aging of accounts receivable method and estimates that $3,000 (thousand) of Accounts Receivable will be uncollectible. Prepare the adjusting journal entry required at February 29 for recording bad debt expense.

3. Repeat requirement 2, except this time assume the unadjusted balance in Red Hat’s Allowance for Doubtful Accounts at February 29 was a debit balance of $1,000 (thousand).

4. If one of Red Hat’s customers declared bankruptcy, what journal entry would be used to write off its $500 (thousand) balance?

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259864230

6th edition

Authors: Fred Phillips, Robert Libby, Patricia Libby