Sikes Corporation, whose annual accounting period ends on December 31, issued the following bonds: Required: 1. For

Question:

Sikes Corporation, whose annual accounting period ends on December 31, issued the following bonds:

Required:

1. For each listed transaction and related adjusting entry, indicate the accounts, amounts, and effects (+ for increase, − for decrease, and NE for no effect) on the accounting equation, using the following format:

Date Assets = Liabilities + Stockholders’ Equity

Date of bonds: January 1, 2018

Maturity amount and date: $200,000 due in 10 years (December 31, 2027)

Interest: 10 percent per year payable each December 31

Date issued: January 1, 2018

Required:

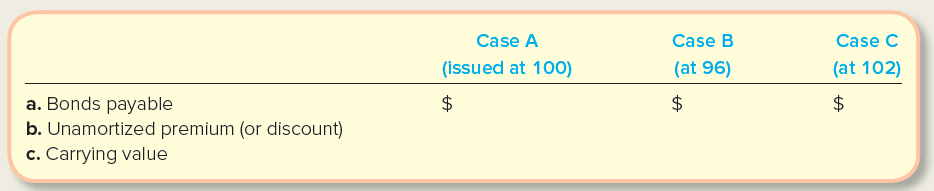

1. For each of the three independent cases that follow, provide the amounts to be reported on the January 1, 2018, financial statements immediately after the bonds are issued:

2. Someone posted the following comment on an investment discussion forum: “Why would I buy a bond at a premium when I can find one at a discount? Isn’t that stupid? It’s like paying list price for a car instead of negotiating a discount.” Write a brief message in response to the posting.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259864230

6th edition

Authors: Fred Phillips, Robert Libby, Patricia Libby