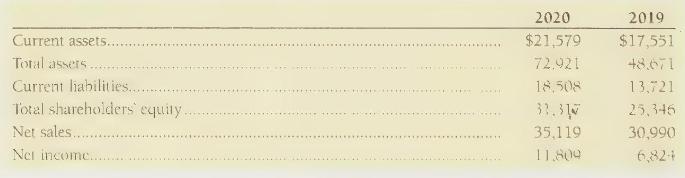

The Cola Company reported the following comparative information at December 31 2020, and December 31, 2019 (amounts

Question:

The Cola Company reported the following comparative information at December 31 2020, and December 31, 2019 (amounts in millions and adapted):

{Requirements}

1. Calculate the following ratios for 2020 and 2019 :

a. Current ratio

b. Debt ratio 2. At the end of 2020 , The Cola Company issued \(\$ 1,590\) million of long-term debt that was used to retire short-term debt. What would the current ratio and debt ratio have been if this transaction had not been made?

3. The Cola Company reports that its lease payments under operating leases will total \(\$ 965\) million in the future and \(\$ 205\) million will occur in the next year (2021). What would the current ratio and debt ratio have been if these leases had been capitalized?

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin