The excerpts that follow are adapted from financial statements of a Canadian not-for profit organization. {Requirements} 1.

Question:

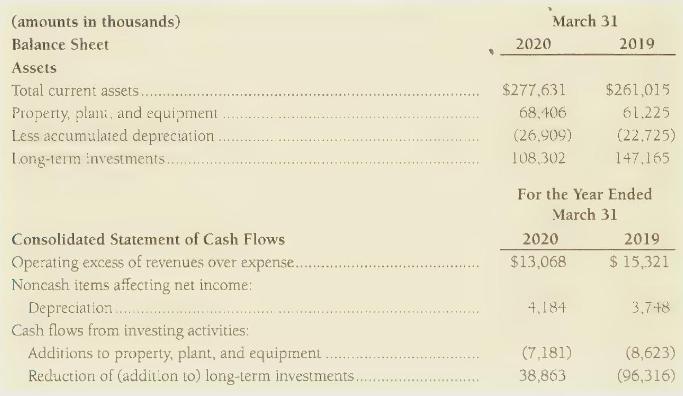

The excerpts that follow are adapted from financial statements of a Canadian not-for profit organization.

{Requirements}

1. How much was the entity's cost of property, plant, and equipment at March 31, 2020? How much was the carrying amount of property, plant, and equipment? Show computations.

2. The financial statements give four pieces of evidence that the entity purchased property, plant, and equipment and sold long-term investments during 2020. What is the evidence?

3. Prepare T-accounts for Property, Plant and Equipment, Accumulated Depreciation, and Long-Term Investments. Then show all the activity in these accounts during 2020. Label each increase or decrease and give its dollar amount.

4. Why is depreciation added to net income on the statement of cash flows?

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin