The four friends who organized Healthcare Services (HS) on January 1, 2017, each invested $10,000 in the

Question:

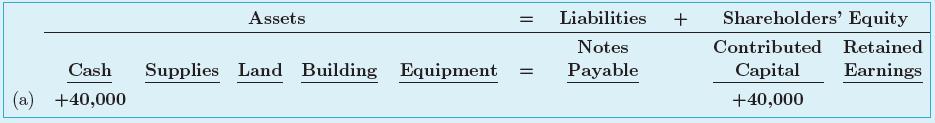

The four friends who organized Healthcare Services (HS) on January 1, 2017, each invested $10,000 in the company and were issued 8,000 common shares. To date, they are the only shareholders. During the first month (January 2017), the company had the following five events:

a. Collected a total of $40,000 from the organizers and issued the shares

b. Purchased a building for $65,000, equipment for $16,000, and three hectares of land for $12,000; paid $13,000 in cash and signed a note for the balance, which is due to be paid in 15 years

c. One shareholder reported to the company that 500 shares of his HS shares had been sold and transferred to another shareholder for $5,000 cash

d. Purchased supplies for $3,000 cash

e. Sold one hectare of land for $4,000 cash to another company

Required:

1. Was Healthcare Services organized as a partnership or corporation? Explain the basis for your answer.

2. During the first month, the records of the company were inadequate. You were asked to prepare a summary of the preceding transactions. To develop a quick assessment of their economic effects on Healthcare Services, you have decided to complete the spreadsheet that follows and to use plus (+) for increases and minus (−) for decreases for each account.

3. Did you include the transaction between the two shareholders—event (c)—in the spreadsheet? Why?

4. Based only on the completed spreadsheet, provide the following amounts (show computations):

a. Total assets at the end of the month

b. Total liabilities at the end of the month

c. Total shareholders’ equity at the end of the month

d. Cash balance at the end of the month

e. Total current assets at the end of the month

5. As of January 31, 2017, has the financing for HS’s investment in assets primarily come from liabilities or from shareholders’ equity?

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh