The Peg Corporation (TPC) issued bonds and received cash in full for the issue price. The bonds

Question:

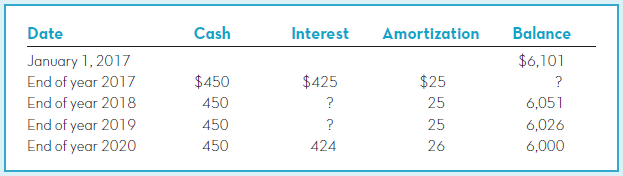

The Peg Corporation (TPC) issued bonds and received cash in full for the issue price. The bonds were dated and issued on January 1, 2017. The stated interest rate was payable at the end of each year. The bonds mature at the end of four years. The following schedule has been prepared (amounts in thousands):

Required:

1. Complete the amortization schedule.TIP: The switch in amortization from $25 to $26 in 2020 is caused by rounding.

2. What was the maturity amount (face value) of the bonds?

3. How much cash was received at date of issuance of the bonds?

4. Was there a premium or a discount? If so, which, and how much was it?

5. How much cash is paid for interest each period and will be paid in total for the full life of the bond issue?

6. What is the stated interest rate?

7. What is the market interest rate?

8. What amount of interest expense should be reported on the income statement each year?

9. Show how the bonds should be reported on the balance sheet at the end of 2018 and 2019.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh