Question:

Use the data in exercise E5-26 to journalize the following for the periodic system:

1. Total October purchases in one summary entry. All purchases were on credit.

2. Total October sales in a summary entry. Assume that the selling price was \(\$ 300\) ) per unit and that all sales were on credit.

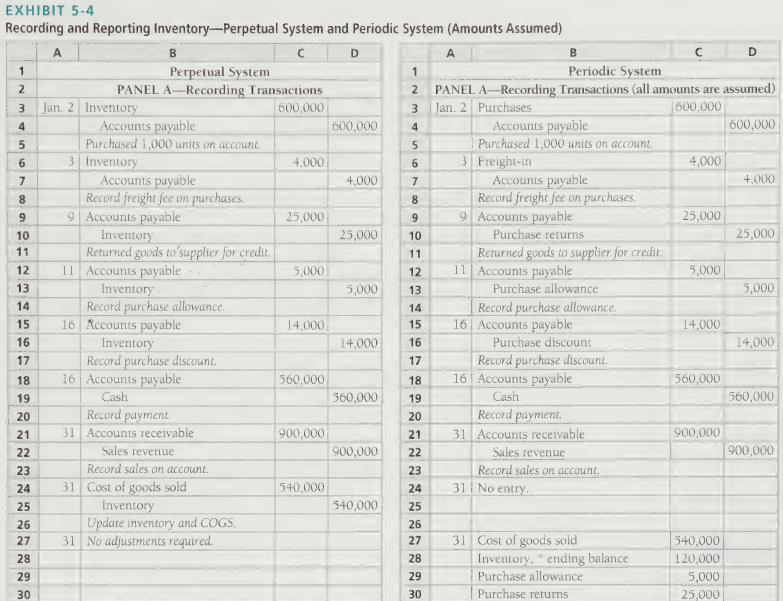

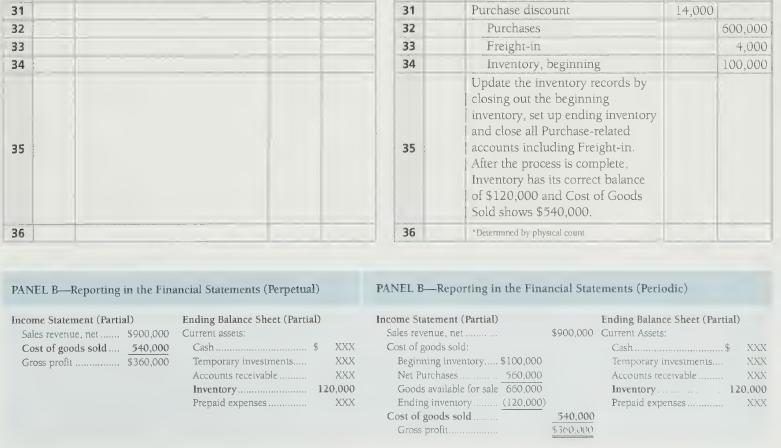

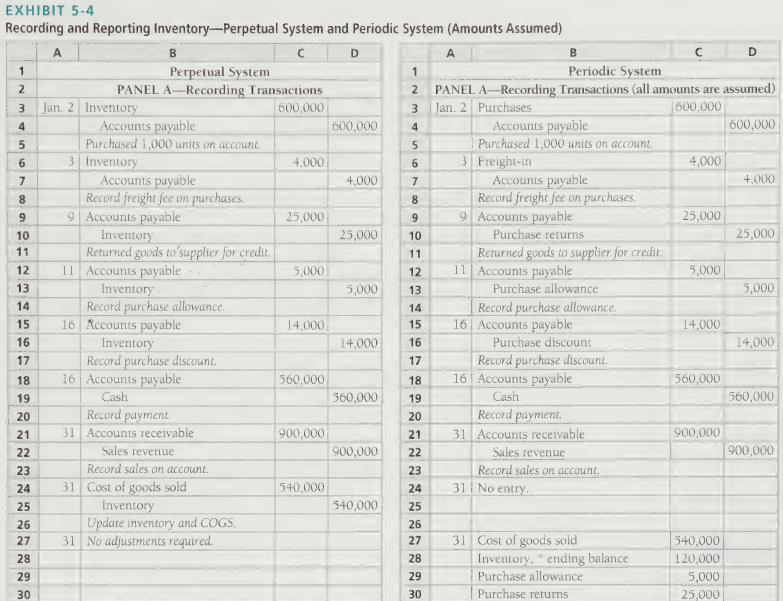

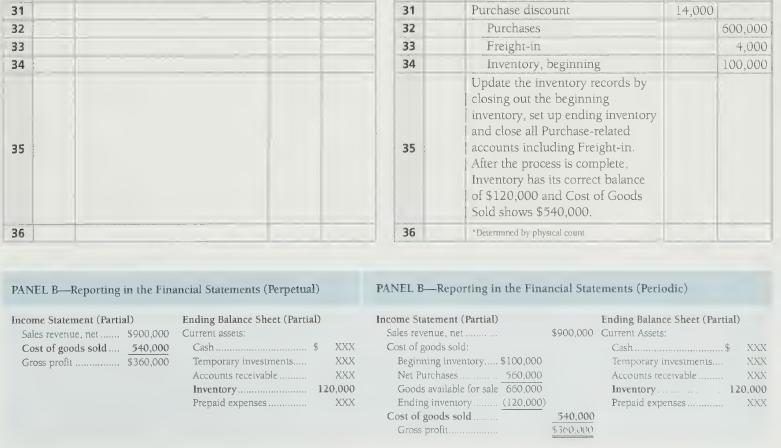

3. October 31 entries for inventory. The company uses weighted-average cost. Post to the Cost of Goods Sold T-account to show how this amount is determined. Label each item in the account 4. Show the computation of cost of goods sold using the example given in Exhibit 5-4, Panel B.

5. Assume it is year end. Prepare the journal entries to update the inventory records.

Exercise 5-26

Suppose a technology company's inventory records for a particular computer chip indicate the following at October 31 :

The physical count of inventory at October 31 indicates that 8 units of inventory are on hand.

Transcribed Image Text:

EXHIBIT 5-4 Recording and Reporting Inventory-Perpetual System and Periodic System (Amounts Assumed) A 1 B Perpetual System CD A B D Periodic System 2 PANEL A-Recording Transactions 2 3 Jan. 2 Inventory 600,000 4 Accounts payable 600,000 5 Purchased 1,000 units on account 67 3 Inventory 4,000 Accounts payable 4,000 8 Record freight fee on purchases. 9 9 Accounts payable 25,000 10 Inventory 25,000 11 Returned goods to supplier for credit 12 11 Accounts payable 5,000 13 Inventory 5,000 14 Record purchase allowance. 15 16 Accounts payable 14,000 16 Inventory 14,000 17 Record purchase discount. 18 16 Accounts payable 560,000 19 Cash 560,000 20 Record payment 21 31 Accounts receivable 900,000 22 Sales revenue 900,000 23 Record sales on account. 24 31 Cost of goods sold 540.000 25 Inventory 540,000 26 Update inventory and COGS 27 31 No adjustments required.. 28 29 3456782U 23ALLTE222222222222 PANEL A-Recording Transactions (all amounts are assumed) Jan. 2 Purchases 600,000 Accounts payable 600,000 Purchased 1,000 units on account 3 Freight-in 4,000 Accounts payable 4,000 Record freight fee on purchases. 9 9 Accounts payable 25,000 10 Purchase returns 25,000 11 12 Returned goods to supplier for credit. 11 Accounts payable 5,000 13 Purchase allowance 5,000 14 Record purchase allowance. 15 16 Accounts payable 14,000 16 Purchase discount 14,000 17 Record purchase discount. 18 16 Accounts payable 560,000 19 Cash 560,000 20 Record payment. 21 31 Accounts receivable 900,000 Sales revenue 900,000 Record sales on account 24 31 No entry. 25 26 27 31 Cost of goods sold 540,000 28 Inventory, ending balance 120,000 29 Purchase allowance 5,000 30 30 Purchase returns 25,000