Walmart and Target are two of the largest and most successful retail chains in the world. To

Question:

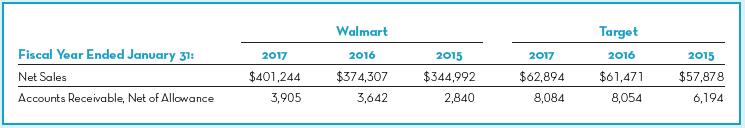

Walmart and Target are two of the largest and most successful retail chains in the world. To evaluate their ability to collect on credit sales, consider the following fictional information reported in their annual reports (amounts in millions).

Required:

1. Calculate the receivables turnover ratios and days to collect for Walmart and Target for the years ended January 31, 2017, and 2016. (Round to one decimal place.)

2. Which of the companies is quicker to convert its receivables into cash?

3. How did the economic difficulties in 2016 to 2017 affect the accounts receivable collections?

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Financial Accounting

ISBN: 9780073527109

3rd Edition

Authors: Fred Phillips, Robert Libby, Patricia A Libby

Question Posted: