Zoom Car Corporation (ZCC) plans to purchase approximately 100 vehicles on December 31, 2017, spending $2 million

Question:

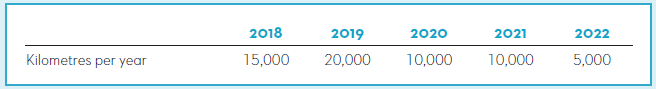

Zoom Car Corporation (ZCC) plans to purchase approximately 100 vehicles on December 31, 2017, spending $2 million plus 11 percent total sales tax. ZCC expects to use the vehicles for five years and then sell them for approximately $420,000. ZCC anticipates the following average vehicle use over each year ended December 31:

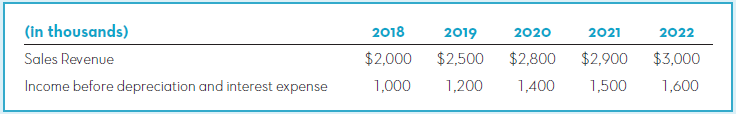

To finance the purchase, ZCC signed a five-year promissory note on December 31, 2017, for $1.8 million, with interest paid annually at the market interest rate of 6 percent. The note carries loan covenants that require ZCC to maintain a minimum times interest earned ratio of 3.0 and a minimum fixed asset turnover ratio of 1.0. ZCC forecasts that the company will generate the following sales and preliminary earnings (prior to recording depreciation on the vehicles and interest on the note). For purposes of this question, ignore income tax.

Required:

1. Calculate the amount of interest expense that would be recorded each year.

2. Calculate the depreciation expense that would be recorded each year, using the (a) straight-line, (b) double-declining-balance, and (c) units-of-production depreciation method.

3. Using your answers to requirements 1 and 2, determine net income and the two loan covenant ratios in each year, assuming the company chooses the (a) straight-line, (b) double- declining-balance, and (c) units-of-production depreciation method.

4. Using your answers to requirement 3, indicate whether the loan covenants would be violated under the (a) straight-line, (b) double-declining-balance, and (c) units-of-production depreciation method.

Asset TurnoverAsset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio. Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh