If the French home currency were to greatly appreciate in value compared to the English currency, what

Question:

a. Make the firm less competitive in the English market.

b. No impact since the major market for East Winery is England, not France.

c. Make the firm more competitive in the English market.

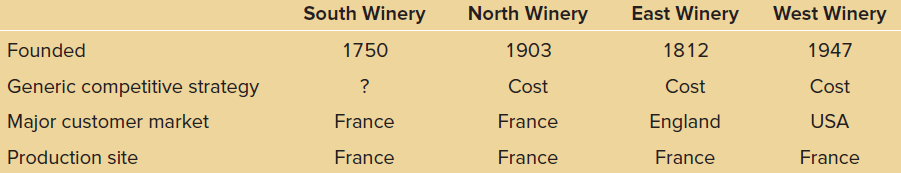

Mary Smith, a Level II CFA candidate, was recently hired for an analyst position at The Bank of Ireland. Her first assignment was to examine the competitive strategies employed by various French wineries. Ms. Smith is eager to impress her boss, Mr. R.D. Van Eaton, and has taken care to make sure she is following the CFA Institute Standards of Practice when writing her research report. Ms. Smith€™s report identifies four wineries that are the major players in the French wine industry. Key characteristics of each are cited in Figure 1.

In the body of Ms. Smith€™s report, she includes a discussion of the competitive structure of the French wine industry. She notes that over the past five years, the French wine industry has not responded to changing consumer tastes. Profit margins have declined steadily, and the number of firms representing the industry has decreased from ten to four. It appears that participants in the French wine industry must consolidate in order to survive.

Ms. Smith€™s report notes that French consumers have strong bargaining power over the industry. She supports this conclusion with five key points.

Bargaining Power of Buyers

1. With meals and at social occasions, many consumers are drinking more beer than wine.

2. Increasing sales over the Internet have allowed consumers to research wines, read opinions from other customers, and identify which producers have the best prices.

3. The French wine industry is consolidating and consists of only four wineries today, compared to 10 wineries five years ago.

4. Over 65 percent of the business for the French wine industry consists of restaurant purchases. Restaurants typically make bulk purchases, buying four to five cases of wine at a time.

5. Land in France where the soil is fertile enough to grow grapes necessary for wine production is becoming harder to find.

After completing the first draft of her report, Ms. Smith takes it to Mr. Van Eaton to review. Mr. Van Eaton tells her that he is a wine connoisseur himself and often makes purchases from the South Winery. Ms. Smith tells Mr. Van Eaton, €œIn my report, I have classified the South Winery as a stuck-in-the-middle firm. It tries to be a cost leader by selling its wine at a price that is slightly below the other firms, but it also tries to differentiate itself from its competitors by producing wine in bottles with curved necks, which increases its cost structure. The end result is that the South Winery€™s profit margin gets squeezed from both sides.€ Mr. Van Eaton replies, €œI have met members of the management team from the South Winery at a couple of the wine conventions. I believe that the South Winery could succeed at both being a cost leader and having a differentiation strategy if the winery separated its operations into distinct operating units, with each unit pursuing a different competitive strategy.€

Figure 1

Ms. Smith makes a note to do more research on generic competitive strategies to verify Mr. Van Eaton€™s assertions before publishing the final draft of her report.

Step by Step Answer:

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin