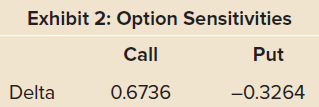

Mr. Franklin wants to compute the value of the put option that corresponds to the call value

Question:

a. $4.78

b. $5.55

c. $11.54

Ronald Franklin, CFA, is responsible for developing a new investment strategy for his firm. Given recent poor performance, the firm wants all of its equity portfolio managers to overlay options on all positions.

Mr. Franklin gained experience with basic option strategies at his previous job. As an exercise, he decides to review the fundamentals of option valuation using a simple example. Mr. Franklin recognizes that the behavior of an option€™s value is dependent on many variables and decides to spend some time closely analyzing this behavior, particularly in the context of the Black-Scholes option pricing model (and assuming continuous compounding). His analysis resulted in the information shown below:

Exhibit 1: Input for Option Pricing

Stock price ......................................................$100

Strike price .....................................................$100

Interest rate ......................................................7%

Dividend yield ...................................................0%

Time to maturity (years) .................................1.0

Standard deviation of stock .........................0.20

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin