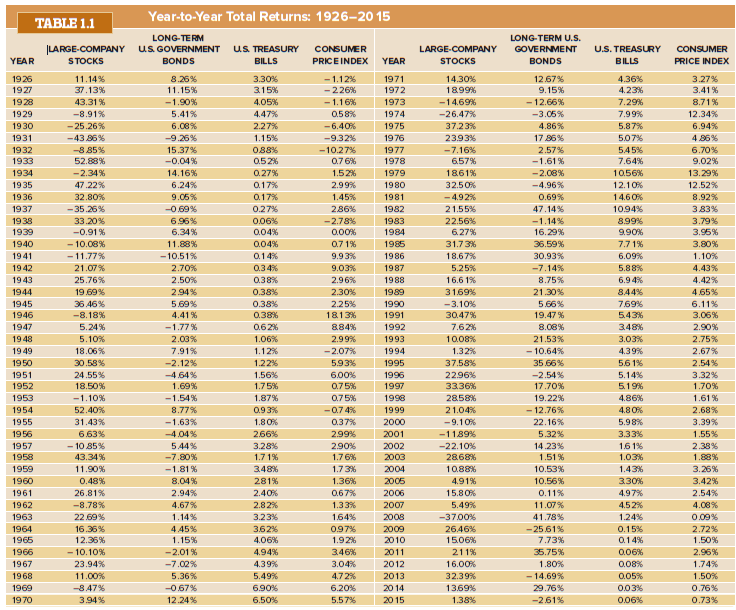

Refer to Table 1.1 for large-company stock and T-bill returns for the period 19731977: a. Calculate the

Question:

a. Calculate the observed risk premium in each year for the common stocks.

b. Calculate the average returns and the average risk premium over this period.

c. Calculate the standard deviation of returns and the standard deviation of the risk premium.

d. Is it possible that the observed risk premium can be negative? Explain how this can happen and what it means.

Year-to-Year Total Returns: 1926–20 15 TABLE 1.1 LONG-TERM U.s. LONG-TERM |LARGE-COMPANY STOCKS uS GOVERNMENT US TREASURY U.S. TREASURY CONSUMER CONSUMER LARGE-COMPANY GOVERNMENT BILLS YEAR BONDS YEAR BONDS PRICEINDEX STOCKS BILLS PRICE INDEX 4.36% 1926 11.14% 8.26% 3.30% -1.12% 1971 14.30% 12.67% 3.27% 37.13% 1899% 9.15% 1927 11.15% 315% -226% 1972 4.23% 3.41% - 12.66% 1928 8.71% 43.31% -1.90% 4.05% - 1.16% 1973 -14.69% 7.29% 4.47% 7.99% 1929 -8.91% 5.41% 0.58% 1974 -26.47% -3.05% 12.34% -6.40% 5.87% 1930 -25.26% 6.08% 2.27% 1975 37.23% 4.86% 6.94% 1931 -43 86% -9.26% 1.15% -9.32% 1976 2393% 17.85% 5.07% 4.,86% 5.45% 1932 -8 85% 15.37% 088% -10.27% 1977 -7.16% 2.57% 6.70% 0.7 6% 1.52% 7.64% 1933 52.88% -0.04% 0.52% 1978 6.57% -1.61% 9.02% 10.56% 1934 -2.34% 14.16% 0.27% 1979 1861% -2.08% 13.29% 6.24% 0.17% 1935 47.22% 2.99% 1980 32.50% -4.96% 12.10% 12.52% 0.17% 1936 32.80% 9.05% 1.45% 1981 - 4.92% 0.69% 14.60% 8.92% 10.94% 1937 - 35.26% -0.69% 0.27% 2.86% 1982 21.55% 47.14% 383% 1938 -2.78% 22.56% 3.79% 3.95% 33.20% 6.96% 0.06% 1983 -1.14% 8.99% 9.90% 1939 -0.91% 6.34% 0.04% 0.00% 1984 6.27% 16.29% - 10.08% - 11.77% 0.7 1% 36.59% 7.7 1% 1940 11.88% 0.04% 1985 31.73% 3.80% 1941 -10.51% 0.14% 9.93% 1986 18.67% 30.93% 6.09% 1.10% 2.70% 0.34% -7.14% 1942 21.07% 9.03% 1987 5.25% 5.88% 4.43% 1943 25.76% 2.50% 0.38% 2.96% 1988 16.6 1% 8.75% 6.9 4% 4.42% 1944 19.69% 2.94% 0.38% 2.30% 1989 31.69% 21.30% 8.44% 4.65% 7.69% 1945 36.46% 5.69% 0.38% 2.25% 1990 -3.10% 5.66% 6.11% 0.38% 0.62% -8.18% 1946 4.41% 1813% 1991 30.47% 19.47% 5.43% 3.06% 5.24% 1947 -1.77% 884% 1992 7.62% 8.08% 348% 2.90% 3.03% 4.39% 56 1% 1948 5.10% 2.03% 1.06% 2.99% 1993 10.08% 21.53% 2.75% 2.67% 1949 18.06% 7.91% 1.12% -2.07% 1994 1.32% - 10.64% 5.93% 1950 30.58% -2.12% 1.22% 1995 37.58% 35.66% 2.54% 1.56% -2.54% 1951 24.55% -4.64% 6.00% 1996 22.96% 5.14% 3.32% 1997 1.70% 1952 18.50% 1.69% 1.75% 0.75% 33.36% 17.70% 5.19% 1953 -1.54% 0.7 5% 1.61% -1.10% 1.87% 1998 2858% 19.22% 4.86% 1954 52.40% 8.77% 0.93% -0.7 4% 1999 21.04% - 12.76% 4.8 0% 2.68% 1955 31.43% -1.63% 1.80% 0.37% 2000 -9.10% 22.16% 5.98% 3.39% 5.32% 14.23% 1956 6.63% -4.04% 2.66% 299% 2001 -11.89% 3.33% 1.55% 290% -22.10% 1.6 1% 1957 - 10 85% 5.44% 3.28% 2002 2.38% 43.34% -7.80% 1958 1.7 1% 1.76% 2003 2868% 1.51% 1.03% 1.88% 11.90% -1.81% 1.43% 1959 3.48% 1.7 3% 2004 10.88% 10.53% 3.26% 3.42% 1960 0.48% 8.04% 281% 1.36% 2005 4.91% 10.56% 330% 0.67% 15.8O% 1961 26.81% 2.94% 2.40% 2006 0.11% 4.97% 2.54% -8.78% 4.67% 1962 2.82% 1.33% 2007 5.49% 11.07% 4.52% 4.08% 2008 1.24% 1963 22.69% 1.14% 3.23% 1.64% -37.00% 41.78% 0.09% 362% 0.15% 1964 16.36% 4.45% 097% 2009 26.46% -25.61% 2.72% 7.73% 1965 12.36% 1.15% 4.06% 1.92% 2010 15.06% 0.14% 1.50% 35.75% 1966 - 10.10% -2.01% 4.94% 346% 2011 211% 0.06% 2.96% 1967 3.04% 1.74% 23.94% -7.02% 4.39% 2012 16.00% 1.80% 0.08% - 14.69% 1968 11.00% 5.36% 5.49% 4.72% 2013 32.39% 0.05% 1.50% -0.67% 6.90% 0.76% 1969 -8.47% 6.20% 20 14 13.69% 29.76% 0.03% 1970 3.94% 12.24% 6.50% 5.57% 20 15 1.38% -2.61% 0.06% 0.73%

Step by Step Answer:

Year Common stocks Tbill return Risk premium 1973 1469 729 2198 1974 2647 799 3446 1975 3723 587 313...View the full answer

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Related Video

Stocks (also known as equities) are securities that represent ownership in a company. They are issued by companies to raise capital, and when an individual buys stocks, they become a shareholder in that company. Investing in stocks can be a way for individuals to potentially earn a return on their investment through dividends and capital appreciation. However, investing in stocks also carries a level of risk, as the value of the stock can fluctuate based on various factors such as the financial performance of the company and general market conditions. For companies, issuing stocks can be a way to raise funds for growth and expansion. When a company goes public by issuing an initial public offering (IPO), it can raise significant capital by selling ownership stakes to the public. Companies can also issue additional stock offerings to raise additional capital as needed.

Students also viewed these Business questions

-

Refer to Table 1.1 for large-stock and T-bill returns for the period 1973-1977: a. Calculate the observed risk premium in each year for the common stocks. b. Calculate the average returns and the...

-

Refer to Table 10.1 in the text and look at the period from 1973 through 1978. a. Calculate the arithmetic average returns for common stocks and T-bills over this period. b. Calculate the standard...

-

Refer to Table 10.1 in the text and look at the period from 1973 through 1978. a. Calculate the arithmetic average returns for large-company stocks and T-bills over this time period. b. Calculate the...

-

Obtain the transfer functions X(s)/F(s) and Y(s)/F(s) for the following model: 3x = y y = f(t) -3y- 15x

-

What is the energy source for the motion of gas in the atmosphere? What prevents atmospheric gases from flying off into space?

-

[The following information applies to the questions displayed below.] The fixed budget for 21,800 units of production shows sales of $610,400; variable costs of $65,400; and fixed costs of $142,000....

-

16.1

-

The cost of Baxters inventory at the end of the year was $50,000. Due to obsolescence, the cost to replace the inventory was only $40,000. Net realizable valuewhat the inventory could be sold foris...

-

Question 4 These financial statement items are for Flint Corporation for the year end, July 31, 2018 Salaries payable $5,435 Salaries expense 51,750 Utilities expense 22,620 Equipment 32,960 Accounts...

-

Given a database of the results of an election, find the number of seats won by each party. There are some rules to going about this: There are many constituencies in a state and many candidates who...

-

Based on the historical record, if you invest in long-term U.S. Treasury bonds, what is the approximate probability that your return will be below 6.3 percent in a given year? What range of returns...

-

Your grandfather invested $1,000 in a stock 50 years ago. Currently the value of his account is $324,000. What is his geometric return over this period?

-

Use the data in Problem and Case 8.2 to prepare calculations for each company to determine the total cost of factoring its accounts receivables. In problem verage annual accounts receivables Average...

-

Nequired information Exercise 5-17 (Static) Notes receivable-interest accrual and collection LO 5-6 (The following information applies to the questions displayed below) Agrico Incorporated accepted...

-

Case 14-3 Sarin Pharmaceuticals Ltd. Alan Mannik, director of procurement for the Sarin Phar- maceuticals Ltd. (Sarin) Animal Health Division plant in Vancouver, British Columbia, was planning for...

-

CL727 LEGAL ANALYSIS AND WRITING Module 11 Assignment: Brief Answer, Analysis, and Conclusion This assignment will be due in Module 11. Your assignment is to write the Brief Answer, Analysis, and...

-

Question 11 (0.5 points) l) Listen } As a drug manufacturer, you expect your latest wonder drug to lower cholesterol. It has been successful with a limited group of participants so far, so you have...

-

Redfern Audio produces audio equipment including headphones. At the Campus Facility, it produces two wireless models, Standard and Enhanced, which differ both in the materials and components used and...

-

Find the slope and the y-intercept of the graph of the linear equation. Then write the equation of the line in slopeintercept form. -4-2 2 -4 2 4 IT x

-

A company produces earbuds. The revenue from the sale of x units of these earbuds is R = 8x. The cost to produce x units of earbuds is C = 3x + 1500. In what interval will the company at least break...

-

Based on the spot rates in Question 21, and assuming a constant real interest rate of 2 percent, what are the expected inflation rates for the next four years?

-

Suppose you buy a 9 percent coupon, 15-year bond today when it's first issued. If interest rates suddenly rise to 15 percent, what happens to the value of your bond? Why?

-

Bond P is a premium bond with an 8 percent coupon, a YTM of 6 percent, and 15 years to maturity. Bond D is a discount bond with an 8 percent coupon, a YTM of 10 percent, and also 15 years to...

-

QUESTION 3 A business owns seven flats rented out to staff at R500 per month. All flats were tenanted Ist january 21 months rent was in arrears and as at 31st December 14 months' rent wa Identify the...

-

1. 2. 3. Select the Tables sheet, select cells A6:B10, and create range names using the Create from Selection button [Formulas tab, Defined Names group]. Select cells B1:F2 and click the Name box....

-

Tropical Rainwear issues 3,000 shares of its $18 par value preferred stock for cash at $20 per share. Record the issuance of the preferred shares. (If no entry is required for a particular...

Study smarter with the SolutionInn App