Suppose the expected market return E(R M ) equals 8%. (a) Compute CAPM betas for the stocks

Question:

Suppose the expected market return E(RM) equals 8%.

(a) Compute CAPM betas for the stocks in problem 1.

(b) Are the data in problem 1 consistent with both the CAPM and the APT?

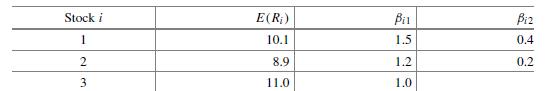

Data from problem 1

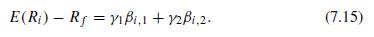

Consider the following APT model:

Suppose that the riskless rate Rf = 5%, and we have the following data for three stocks.

Transcribed Image Text:

E(R) Rf=yBi,1 + 12Bi,2. (7.15)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Investment Valuation And Asset Pricing Models And Methods

ISBN: 9783031167836

1st Edition

Authors: James W. Kolari, Seppo Pynnönen

Question Posted:

Students also viewed these Business questions

-

While you are running down the street you give off 4.7x10 4 joules of heat and you do 6.8x10 4 J of work. What is your change in internal energy?

-

Q1. You have identified a market opportunity for home media players that would cater for older members of the population. Many older people have difficulty in understanding the operating principles...

-

CANMNMM January of this year. (a) Each item will be held in a record. Describe all the data structures that must refer to these records to implement the required functionality. Describe all the...

-

Different theories about early childhood inform approaches to children's learning and development. Early childhood educators draw upon a range of perspectives in their work ..." (EYLF p.12)....

-

What is the value of getting employees to compete against a goal instead of against one another?

-

Name three different applications where ROMs are often used.

-

Assume you are the human resource director for a large, diversified company and you want to develop a tentative policy about employee napping to boost productivity and reduce stress. Perhaps you...

-

1. At December 31, 2011, Kale Co. had the following balances in the accounts it maintains at First State Bank: Checking account No. 001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

Inteli Inc. is calculating the present value of estimated cash flows for environment remediation, which is expected to take place in 1 5 years. The cost of the remdiation is estimated as foolows,...

-

Refer to the Campbell Soup annual report in Appendix A. Required: a. What type of pension plan does Campbell Soup offer its employees? b. Does Campbell Soup have a net pension asset or a net pension...

-

Form the equal-weighted portfolio of the stocks in problem 1. (a) Compute i , 1 and i , 2 for the portfolio. (b) Compute the expected return of the portfolio. (c) Compute the portfolios risk...

-

During the course of your employment, you may have experienced working for both a male and female supervisor. Discuss from your personal point of view the advantages/disadvantages and like/dislike of...

-

What do you think of the gainsharing plan that Harrah's has implemented? How does an employee make more money? How much more money can they make? Is the gainsharing plan motivating employees to...

-

How do power dynamics within an organization affect employee empowerment and autonomy, and what are the best practices for creating a balanced power structure ?

-

In thinking about management and incentive structures: What recommendations do you have for the Responsible Innovation team as they seek to better embed responsible innovation within employees'...

-

How do multinational companies adapt their corporate governance procedures and decisions to accommodate the different national and regional regulatory requirements and business ethics? Requirement: I...

-

How do "complexity theory" and the concept of "emergent properties" inform our understanding of organizational dynamics, particularly in the context of nonlinear interactions and unpredictable...

-

Is the Sec. 704(d) loss limitation rule more or less restrictive than the at-risk rules? Explain.

-

What are some of the features of the Unified Process (UP)?

-

Ms. Yamisaka has determined that the average monthly return of another Mega client was 1.63 percent during the past year. What is the annualized rate of return? a. 5.13 percent b. 19.56 percent c....

-

The return calculation method most appropriate for evaluating the performance of a portfolio manager is a. Holding period b. Geometric c. Money-weighted (or dollar-weighted)

-

The rates of return on Cherry Jalopies, Inc., stock over the last five years were 17 percent, 11 percent, 2 percent, 3 percent, and 14 percent. Over the same period, the returns on Straw Construction...

-

What is the present value of $500 invested each year for 10 years at a rate of 5%?

-

GL1203 - Based on Problem 12-6A Golden Company LO P2, P3 Golden Corp.'s current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are...

-

A project with an initial cost of $27,950 is expected to generate cash flows of $6,800, $8,900, $9,200, $8,100, and $7,600 over each of the next five years, respectively. What is the project's...

Study smarter with the SolutionInn App