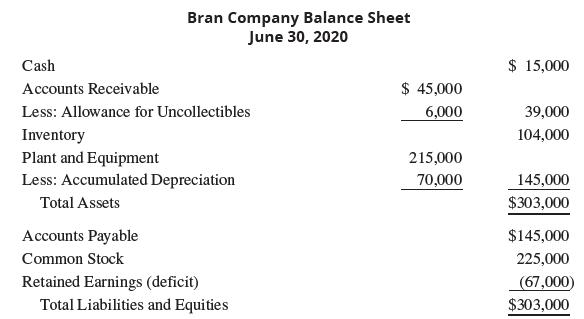

A balance sheet for Bran Company on June 30, 2020, the date Jim Brown was appointed trustee,

Question:

A balance sheet for Bran Company on June 30, 2020, the date Jim Brown was appointed trustee, is presented here:

The following information concerning the period from June 30, 2020, to December 31, 2020, is also available:

1. All Bran Company’s assets were transferred to the trustee.

2. Sales for the period were $130,000, of which $30,000 were cash sales.

3. Receivables collected by the trustee in cash were:![]()

4. Merchandise inventory was purchased on account by the trustee in the amount of $35,000.

5. Cash payments were made by the trustee for:

(a) Accounts payable (old), $110,000

(b) Accounts payable (new), $30,000

(c) Operating expenses, $47,000

(d) Trustee expense, $2,000

6. Adjusting entries recorded by the trustee on December 31, 2020, were:

(a) Estimated uncollectibles Accounts receivable (old) $1,000 Accounts receivable (new) 2,000

(b) Accounts receivable written off (old), $7,000

(c) Depreciation expense, $10,000

7. The merchandise inventory balance on December 31 was $75,000.

8. The plant and equipment included a parcel of land and a piece of equipment, both of which were sold by the trustee for cash. The land cost $14,000 and was sold for $25,000. The equipment, which had a book value of $25,000 (cost, $50,000; accumulated depreciation, $25,000), was sold for $13,000.

Required:

Prepare a realization and liquidation account, including a copy of the cash account, for the period June 30, 2020, to December 31, 2020. Use the alternate approach for reporting the components of the net gain or loss on the sale of land and equipment.

Step by Step Answer: