Apple Company was incorporated in Delaware in 2017. On November 2, 2024, the controller of the company

Question:

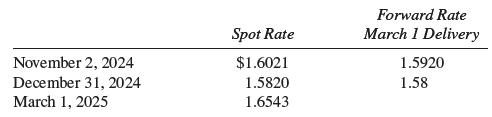

Apple Company was incorporated in Delaware in 2017. On November 2, 2024, the controller of the company entered into a forward contract to sell 50,000 British pounds for $1.5920 on March 1, 2025. The following exchange rates were quoted on the indicated dates:

Apple Company’s fiscal year- end is December 31.

Required:

A. Assume that the forward contract was entered into as a hedge against an exposed foreign currency receivable balance in the amount of £50,000. Prepare the journal entries that would be made by Apple Company on

1. November 2— to record the sale of the goods on account for £50,000 and to record the forward contract.

2. December 31— to adjust the accounts related to the exposed asset and forward contract at fiscal year- end.

3. March 1— to adjust the accounts related to the exposed asset and forward contract and to record the settlement of the receivable and delivery of the pounds to the exchange dealer.

B. Assume that the controller indicated on November 2 that the forward contract was acquired as a hedge of a future foreign currency transaction that is a commitment of Apple to sell inventory for £50,000 on March 1. Apple Company designates this hedge as a fair value

hedge of an unrecognized firm commitment. Prepare the journal entries related to the forward contract and commitment to sell inventory that would be made by Apple Company on November 2, December 31, and March 1.

C. Assume that the contract was entered into to speculate in future exchange rate fluctuations. Prepare the journal entries that would be made by Apple Company on November 2, December 31, and March 1.

D. Compute the effect of the transactions in (A), (B), and (C) on the net income for the fiscal years ended December 31, 2024, and December 31, 2025. Indicate how the balance sheet accounts related to the forward contract would be reported in the December 31, 2024, balance sheet.

Step by Step Answer: