Select the best answer for each of the following. 1. A sale of goods by a U.S.

Question:

Select the best answer for each of the following.

1. A sale of goods by a U.S. company was denominated in a foreign currency. The sale resulted in a receivable that was fixed in terms of the amount of foreign currency that would be received. Exchange rates between the dollar and the currency in which the transaction was denominated changed so that a loss was incurred. This loss should be included as a(n)

(a) Extraordinary item in the income statement.

(b) Component of income from continuing operations.

(c) Separate component of stockholders’ equity.

(d) Deferred item in the balance sheet.

2. On September 1, 2024, Change Corp. received an order for equipment from a foreign customer for 300,000 units of foreign currency when the U.S. dollar equivalent was $96,000. Change shipped the equipment on October 15, 2024, and billed the customer for 300,000 units of foreign currency when the U.S. dollar equivalent was $110,000. Change received the customer’s remittance in full on November 16, 2024, and sold the 300,000 foreign currency units for $105,000. In its income statement for the year ended December 31, 2024, Change should report a foreign exchange loss of

(a) $9,000

(b) $5,000

(c) $14,000

(d) $— 0—

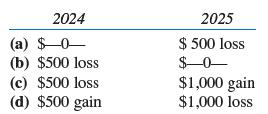

3. McNeil, a U.S. corporation, bought inventory items from a supplier in Denmark on November 5, 2024, for 100,000 krones, when the spot rate was $.4395. At McNeil’s December 31, 2024, year- end, the spot rate was $.4345. On January 15, 2025, McNeil bought 100,000 krones at the spot rate of $.4445 and paid the invoice. How much should McNeil report in its income statement for 2024 and 2025 as transaction gain or loss?

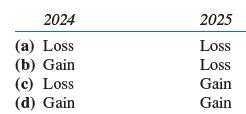

4. During 2024 a U.S. firm sold inventory to a foreign customer. The transaction was denominated in the local currency of the buyer. The direct exchange rate decreased from the date of the transaction to the end of the fiscal period; the rate increased from the end of the fiscal year to the date the account was settled in 2025. A transaction gain or loss should be recognized

Step by Step Answer: