Dorsey Corporation purchased 90% of the common stock of Lansing Company on January 1, 2018. The cost

Question:

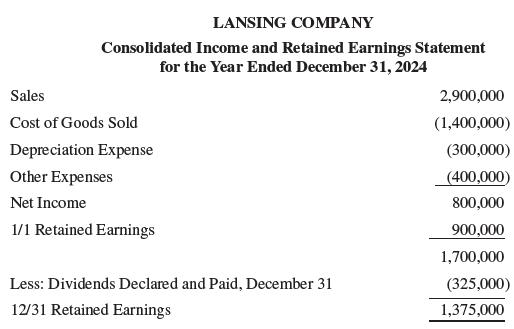

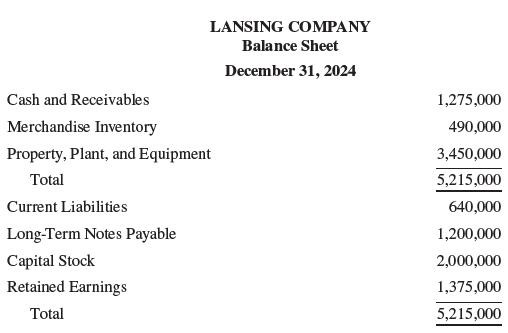

Dorsey Corporation purchased 90% of the common stock of Lansing Company on January 1, 2018. The cost of the investment was equal to the book value interest acquired. Lansing Company operates two retail stores and an exporting business in London that specializes in buying and selling British tweeds. The subsidiary provided the following financial statements in pounds to the parent company:

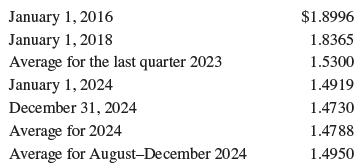

Lansing Company was incorporated on January 1, 2016, at which time all the property, plant, and equipment was purchased. The long- term notes were issued to partially finance the purchase of the fixed assets. Direct exchange rates for the British pound are as follows:

The January 1, 2024, retained earnings balance of Lansing in dollars was $1,593,408, and the cumulative translation adjustment was a debit balance of $939,898. The beginning inventory of £420,000 was acquired during the last quarter of 2023 and the ending inventory was acquired during the last five months of 2024. Sales were made and purchases and other expenses were incurred evenly during the year.

Required: Translate the December 31, 2024, account balances of Lansing Company into dollars assuming that the pound is the functional currency of Lansing Company.

Step by Step Answer: