Forester Company is evaluating the purchase of equipment from two vendors. Differences in the technology and labor

Question:

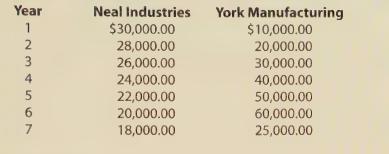

Forester Company is evaluating the purchase of equipment from two vendors. Differences in the technology and labor requirements to operate the equipment of each vendor affect the projected net cash flows. The equipment purchased from Neal Industries would cost \($97,250.00\) and is projected to generate total net cash flows of \($168,000.00.\) The equipment from York Manufacturing would cost \($135,200.00\) and is projected to generate net cash flows totaling \($235,000.00.\) The net cash flows for each year follow.

Instructions:

1. Assuming that Forester Company wants to earn a 12% rate of return, calculate the net present value of each equipment purchase.

2. Would you purchase the equipment and, if so, from which vendor?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: