Introductory remarks: Some businesses record purchases at the net amount to be paid when the cash discount

Question:

Introductory remarks: Some businesses record purchases at the net amount to be paid when the cash discount is taken. For example, merchandise is purchased for \($1,000.00\) with a 2% discount allowed if the account is paid within 10 days. The discount will reduce the price from \($1,000.00\) to \($980.00.\) To record this purchase on account transaction, Purchases is debited for \($980.00\) and Accounts Payable is credited for \($980.00.\) When the account is paid, Accounts Payable is debited for \($980.00\) and Cash is credited for \($980.00.\) Purchases returns and allowances are also recorded at the discounted amount. For example, a purchase return of \($100.00\) would be a debit to Accounts Payable of \($98.00\) and a credit to Purchases Returns and Allowances of \($98.00.\)

If the discount period expires before payment is made, the entry in the cash payments journal for the example above would be as follows: debit Accounts Payable for \($980.00,\) debit Discounts Lost for \($20.00,\) and credit Cash for \($1,000.00.\) Because most cash discounts are taken, there are few entries involving the discounts lost account. For this reason, no special amount column is provided for the account in the cash payments journal. Instead, the amounts debited to this account are recorded in the General Debit column.

Instructions:

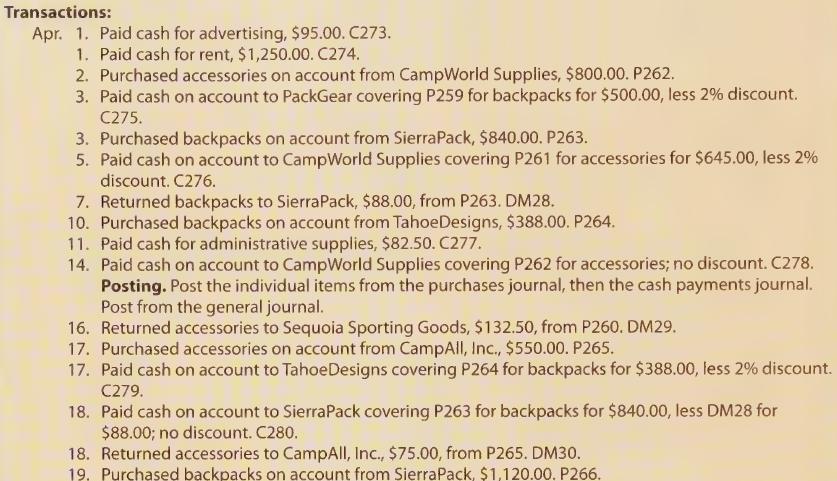

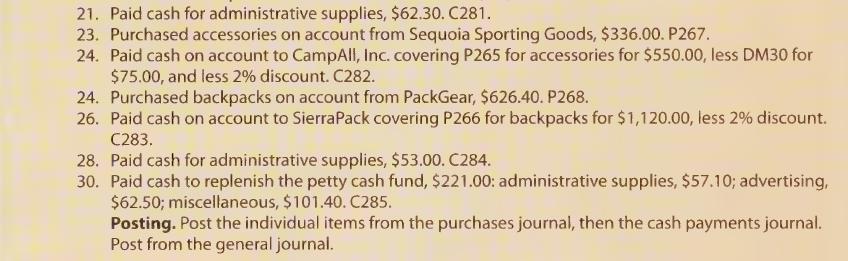

1. Journalize the transactions for Mastery Problem 1-4 following the method described above. Use purchases journal, general journal, and cash payments journal. All of the vendors from which merchandise is purchased on account offer terms of 2/10, n/30.

2. Prove and rule the special journals.

Data from Problem 1-4

Outdoor Sport has two departments: Backpacks and Accessories. Source documents are abbreviated as follows: check, C; debit memorandum, DM; purchase invoice, P.

Step by Step Answer: