Cayman Company uses a voucher system. All of the vendors with whom Cayman Company does business offer

Question:

Cayman Company uses a voucher system. All of the vendors with whom Cayman Company does business offer terms of 2/10, n/30. Cayman has a policy of paying all invoices within the discount period. The business records invoice vouchers at the net amount (invoice total less a 2% discount). Thus, a \($1,000.00\) invoice, allowing a 2% discount of \($20.00,\) is recorded at the net amount, \($980.00.\) Purchases is debited and Vouchers Payable is credited for \($980.00.\) A purchases discount account is not used.

If an invoice is not paid within the discount period, Cayman Company loses the discount. This loss is recorded in an account titled Discounts Lost. Thus, if the \($1,000.00\) invoice described above is not paid within the discount period, the business must pay the full \($1,000.00.\) However, one of the controls in a voucher system is that no check can be written for more than the voucher amount. Therefore, for a check to be written for the full \($1,000.00,\) the original voucher must be canceled. A new voucher for \($1,000.00\) must be prepared, approved, and recorded.

This new voucher would include a debit to Discounts Lost of \($20.00,\) a debit to Vouchers Payable of \($980.00\) (the amount of the original voucher), and a credit to Vouchers Payable of \($1,000.00.\) Once this voucher is approved, a check can be written for \($1,000.00\) to pay the full amount due.

If an invoice is recorded at its net amount, all purchases returns and allowances are recorded at net amounts. A \($1,000.00\) invoice recorded at net with a 2% discount has a \($100.00\) purchase return and allowance.

Thus, the \($100.00\) return is discounted by 2% and recorded as \($98.00.\) For the return, Vouchers Payable is debited \($980.00\) (the amount of the original voucher), Purchases Returns and Allowances is credited for \($98.00,\) and Vouchers Payable is credited for \($882.00\) (the amount of the new voucher).

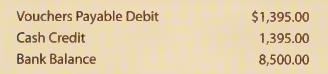

Cayman’s voucher register is similar to the one described for OfficeMart in this chapter. However, the third amount column is titled Discounts Lost. There is only one Supplies Debit column because there is only one supplies account. Cayman’s check register has two special amount columns: Vouchers Payable Debit and Cash Credit.

Instructions:

1. Use page 20 of a check register. Record the amounts brought forward on December 11 of the current year.

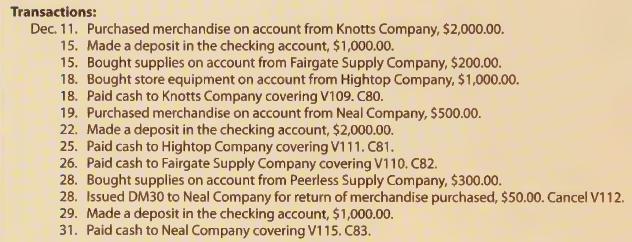

2. Journalize the transactions completed during December of the current year. Use page 25 of a voucher register. Assume that for all purchases of merchandise, equipment, or supplies, the invoice terms are 2/10, n/30. When a voucher is paid or canceled, make appropriate notations in the voucher register. Number vouchers consecutively starting with Voucher No. 109. Source documents are abbreviated as follows:

check, C; debit memorandum, DM; voucher, V.

3. Prove and rule both the voucher register and the check register.

Step by Step Answer: