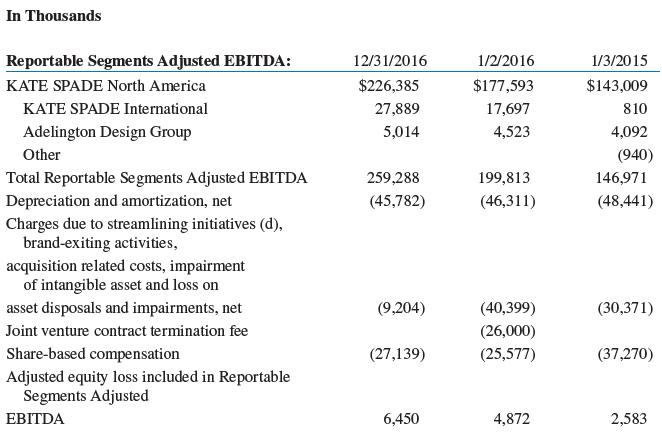

Kate Spade, in 2016, operated in three reportable segments: Kate Spade North America, Kate Spade International, and

Question:

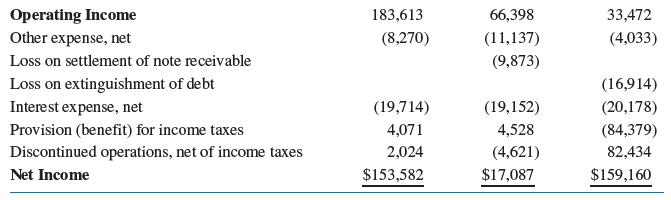

Kate Spade, in 2016, operated in three reportable segments: Kate Spade North America, Kate Spade International, and Adelington Design Group. Late in 2016, Coach acquired Kate Spade. One of the required segmental disclosures is a reconciliation of the segment profit or loss to net income.

Required:

EBITDA or Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) is normally required to be a non- GAAP number subject to the SEC’s non- GAAP disclosures. Why is Kate Spade allowed to use EBITDA without using the Non- GAAP label?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: