Net cash flows from operating activities were a. ($12,000). b. ($20,000). c. ($24,000). d. ($25,000). Comparative consolidated

Question:

Net cash flows from operating activities were

a. \($12,000\).

b. \($20,000\).

c. \($24,000\).

d. \($25,000\).

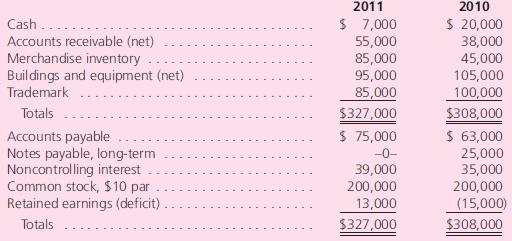

Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent–owned subsidiary Oakley Co. follow:

Additional Information for Fiscal Year 2011

• Iverson and Oakley’s consolidated net income was \($45,000\).

• Oakley paid \($5,000\) in dividends during the year. Iverson paid \($12,000\) in dividends.

• Oakley sold \($11,000\) worth of merchandise to Iverson during the year.

• There were no purchases or sales of long-term assets during the year.

In the 2011 consolidated statement of cash flows for Iverson Company:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: