On December 1, 2024, King Company exported equipment that had cost $210,000 to a Brazilian company for

Question:

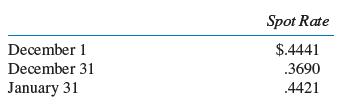

On December 1, 2024, King Company exported equipment that had cost $210,000 to a Brazilian company for 1,000,000 real. The account is to be settled on January 31, 2025. King Company is a calendar- year company and uses a perpetual inventory system. Direct exchange rates were:

Required:

A. Prepare journal entries to record the exporting transaction, adjust the accounts on December 31, and settle the account on January 31.

B. What effect did changes in the exchange rate have on income in 2024 and 2025?

C. Assume the facts given above, except that on December 1, King Company entered into a forward contract to sell 1,000,000 Real on January 31 for $.4451 per real. Prepare the journal entries needed in 2024 and 2025 to record the forward contract and settle the accounts. The

forward rate on December 31 for January 31 delivery was $.3810.

D. What is the combined effect on income in 2024 and 2025 from the exporting transaction and the forward contract?

Step by Step Answer: