On December 1, 2024, Tuscano Corp. entered into a transaction to import raw materials from a foreign

Question:

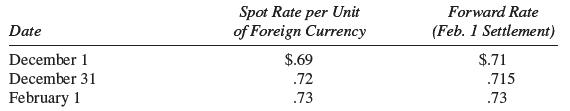

On December 1, 2024, Tuscano Corp. entered into a transaction to import raw materials from a foreign company. The account is to be settled on February 1 with the payment of 60,000 foreign currency units (FCU). On December 1, Tuscano also entered into a forward contract to hedge the exposed position resulting from the import transaction. The forward rate is $.71 per unit of foreign currency. Tuscano Corp. has a December 31 fiscal year- end. Spot rates and the forward rates on relevant dates were:

Required:

Use the data given to select the best answer to each question.

1. The forward contract entered into on December 1 is an example of

(a) A hedge of an exposed receivable position.

(b) A hedge of a foreign currency commitment.

(c) A contract entered into for speculation.

(d) A hedge of an exposed payable position.

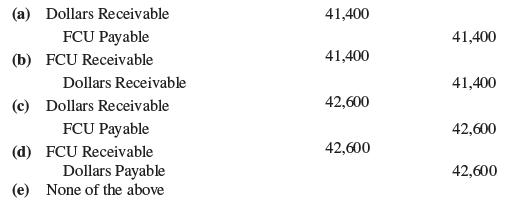

2. The entry to record the forward contract is

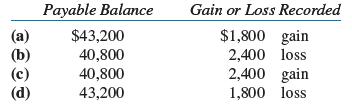

3. On December 31, what will be the adjusted balance in the Accounts Payable account and how much gain or loss was recorded as a result of the adjustment?

4. What amount of net transaction gain or loss from the transactions should be included in the determination of the 2024 net income?

(a) $1,500 loss.

(b) $1,800 loss.

(c) $— 0— Because a gain or loss on the forward contract is offset by a loss or gain on the exposed position.

(d) $2,400 gain.

5. Which of the following statements is not true?

(a) Assuming the account payable is to be settled on February 1, Tuscano Corp. was able to reduce its cash outflow for the purchases as a result of entering into the forward contract.

(b) During 2025, a transaction loss of $600 was recorded on the forward contract.

(c) Tuscano Corp. paid $42,600 to complete the forward contract.

(d) During 2025 a transaction loss of $600 was recorded on the exposed payable.

Step by Step Answer: