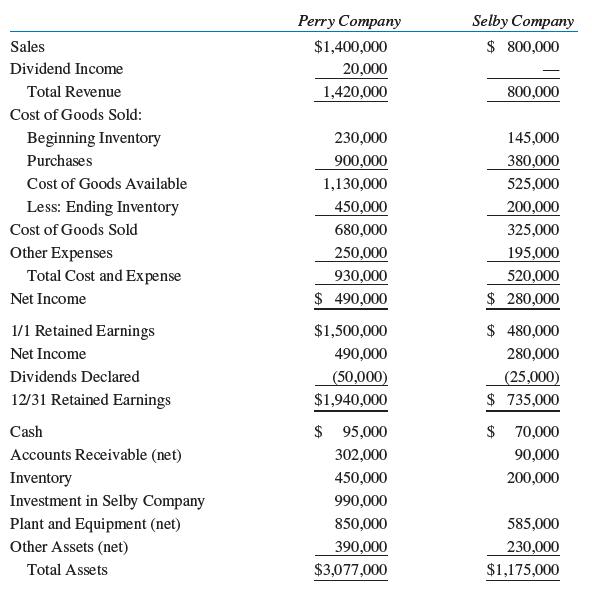

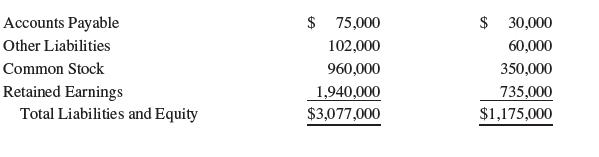

On January 1, 2022, Perry Company purchased 80% of Selby Company for $990,000. At that time Selby

Question:

On January 1, 2022, Perry Company purchased 80% of Selby Company for $990,000. At that time Selby had capital stock outstanding of $350,000 and retained earnings of $375,000. The fair value of Selby Company’s assets and liabilities is equal to their book value except for the following:

One- half of the inventory was sold in 2022, the remainder was sold in 2023. At the end of 2022, Perry Company had in its ending inventory $60,000 of merchandise it had purchased from Selby Company during the year. Selby Company sold the merchandise at 25% above cost. During 2023, Perry Company sold merchandise to Selby Company for $310,000 at a markup of 20% of the selling price. At December 31, 2023, Selby still had merchandise that it purchased from Perry Company for $82,000 in its inventory. Financial data for 2023 are presented here:

Required:

A. Prepare the consolidated statements workpaper for the year ended December 31, 2023.

B. Calculate consolidated retained earnings on December 31, 2023, using the analytical or t- account approach.

Step by Step Answer: