Sass, Inc., completed the following transactions during the current year. Sass initially records prepaid expenses as expenses.

Question:

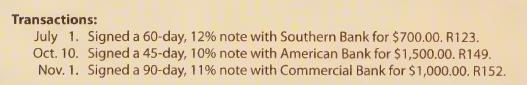

Sass, Inc., completed the following transactions during the current year. Sass initially records prepaid expenses as expenses. Source documents are abbreviated as follows: check, C; receipt, R.

Instructions:

1. Journalize the transactions on page 15 of a cash receipts journal.

2. Calculate the maturity dates for each note.

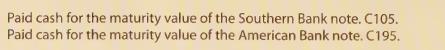

3. Journalize the following transactions on page 21 of a cash payments journal. Use the AEN dates calculated in the prior step.

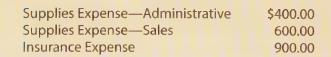

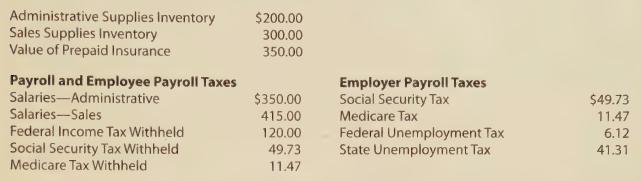

4. Sass, Inc., has the following general ledger balances on December 31 of the current year before adjusting entries are recorded.

Use the following information to journalize adjusting entries for prepaid expenses and accrued expenses on December 31 of the current year. The estimated federal income tax is $800.00. Include the adjusting entry for the outstanding note payable. Use page 13 of a general journal.

5. Journalize the appropriate reversing entries on January 1 of the next year. Use page 1 of a general journal.

Step by Step Answer: