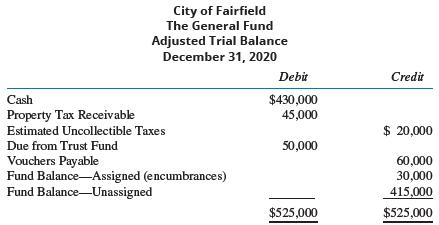

The trial balance for the General Fund of the City of Fairfield as of December 31, 2020,

Question:

The trial balance for the General Fund of the City of Fairfield as of December 31, 2020, is presented here:

Transactions for the year ended December 31, 2021, are summarized as follows:

1. The City Council adopted a budget for the year with estimated revenue of $735,000 and appropriations of $700,000.

2. Property taxes in the amount of $590,000 were levied for the current year. It is estimated that $24,000 of the taxes levied will prove to be uncollectible.

3. Proceeds from the sale of equipment in the amount of $35,000 were received by the General Fund. The equipment was purchased 10 years ago with resources of the General Fund at a cost of $150,000. On the date of purchase, it was estimated that the equipment had a useful life of 15 years.

4. Licenses and fees in the amount of $110,000 were collected.

5. The total amount of encumbrances against fund resources for the year was $642,500.

6. Vouchers in the amount of $455,000 were authorized for payment. This was $15,000 less than the amount originally encumbered for these purchases.

7. An invoice in the amount of $28,000 was received for goods ordered in 2020. The invoice was approved for payment.

8. Property taxes in the amount of $570,000 were collected.

9. Vouchers in the amount of $475,000 were paid.

10. Fifty thousand dollars was transferred to the General Fund from the Trust Fund.

11. The City Council authorized the write- off of $30,000 in uncollected property taxes.

Required:

A. Prepare entries in general journal form to record the transactions for the year ended December 31, 2021.

B. Prepare a preclosing trial balance for the General Fund as of December 31, 2021.

Step by Step Answer: